It’s been a frantic start to the year, with so many questions arising out of last year. After a tough end of year for Stockmarkets, where to for 2019?

December 2018

There were plenty of naysayers towards the end of 2018. December saw a rare occurrence where no ‘Santa Clause rally’ took place. This left markets falling and the media predicting a tough year ahead.

In December we say the following returns for overseas markets:

– USA S&P 500 -8.8%

– Europe -5.3%

– Emerging Markets EM -3.0%

– Australia ASX 200 – 0.12%

What was interesting, was what occurred in January.

Do you see a similarity?

– USA S&P 500 +8.0%

– Europe +6.6%

– Emerging Markets +9.6%

– Australia ASX200 + 3.17%

It’s fair to say that the ‘new normal’ will be ongoing volatility.

This time last year, we wrote of how the VIX (ie. the Volatility Index) was at a record low.

This refers to the fact that markets were like a ‘smooth pond of water’ with little change other than an upward trend. Historically they ‘water’ tends to get choppy at times.

In simple terms, we’re all back to experiencing choppy water with markets.

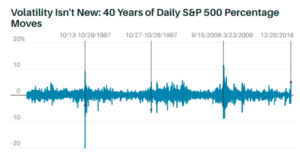

What does Volatility Look Like Historically?

This chart below gives you a guide over 40 years. In recent times, you can see that it’s a lot lower.

Lessons Learnt

A financial adviser with 30 years experience in the USA recently spoke about how he always tells new clients that “The most important thing for me to manage is their behaviour. Humans do more damage to investment results than any market condition I’ve experienced”.

This has a lot of merit.

Focusing upon your ‘Plan’ and managing your assets accordingly is far more important than simply timing your asset allocation particularly whilst in your working phase of life.

Summary

By all means, read through the forecasts and predictions, and I’ll give you some links to follow below.

But we’ve done this exercise for many years in the past. The forecasts and predictions that we’ve cut/paste have never been exactly correct and many were wayyyy off the mark.

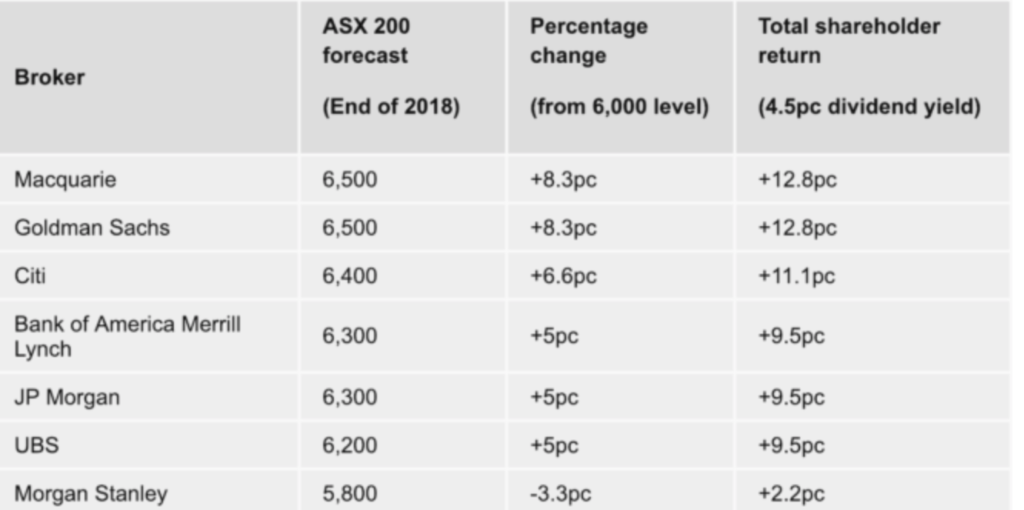

Here’s a table just from 2018 alone.

The ASX 200 closed off the year with a -6.9% decline in value.

What was predicted?

Yep, all except for Morgan Stanley expected an increase by 5 to 8.3%. (reference www.fool.com.au)

Please, like those cigarette box warnings, I’d suggest these 2019 forecast articles need the same type of text:-

Caution: These forecasts can be a risk to your wealth.

Articles for Entertainment

(Let’s check back in January 2020 to see how they fared)

ASX index tipped to rise by 20% in 2019

JP Morgan predicts 17% surge for US markets

Outlook for 2019 – another cycle extension (Shane Oliver AMP)

ASX Back to 6000 (Morgan Stanley)

3 ASX Stocks to buy in 2019 (NAB Trade)

Lincoln’s 8 star stocks for 2019

Markets set to fall by 50% in 2019

PS – here’s an article I suggest that is worthwhile reading, courtesy of Barry Ritholtz:

2019 Forecast Predictions will be wrong, random or worse

(December and January Stockmarket returns are referenced via Ben Carlson and iShares ASX)