In September 2018, Dean Baker of the Center for Economic and Policy Research published a white paper that analysed the Global Financial Crisis (GFC) called The Housing Bubble and the Great Recession: 10 Years Later.

As a result of this economic crisis, millions of people lost their jobs and homes all across the United States.

The stock market and property markets suffered significant falls and the impact was felt globally.

At the time, the media and financial industry attributed the trigger of the GFC to the collapse of investment bank, Lehmann Brothers.

New Insights

With hindsight, the author of this paper argues that there is evidence that this was not the case.

As a lead up into the GFC, the United States experienced an unprecedented price increase for houses.

As a consequence, the housing bubble was a key driver for the country’s economy.

Baker’s view is that the primary cause of the GFC was the bursting of the residential housing bubble.

Why Should We Care?

This begs the question what parallels does the Australian economy have currently, with the USA from 10 years ago.

With a focus upon high priced housing in Australia we hear many reasons as to why our house prices have increased substantially. They all seem logical enough.

Baker points to very similar reasoning for the US house prices including from the Federal Reserve Chairman at the time, Alan Greenspan that he believes with history were shown to be erroneous.

It would be prudent to compare these facts further and understand where Australia may be positioned in 2019, compared to where the USA was in 2008.

In both countries housing price had increased significantly

The USA had unprecedented house price increases nationally.

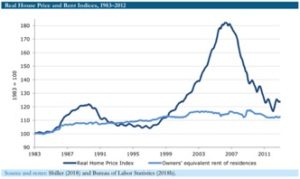

This graph below illustrates the USA Real House Price index between 1999 and 2007. It’s a significant increase, followed by the sharp fall post-GFC in 2008.

In Australia, similar price increases are exhibited. According to a paper released by the RBA, the 1990s until the mid 2000s were marked by quite high housing price inflation, of 7.2 per cent per annum, on average, in nominal terms.

Reference: LF Economics.com

Why The Significant Price Increase?

We often hear many reasons for higher prices in real estate. Baker takes the view that many of the arguments can be easily dismissed with a cursory examination of the data and recent history.

We take a look at the 4 reasons that Baker highlights were reasons for the USA house price surge, and how that compares to recent Australian property market trends.

Rents Are Rising (increasing investor demand and prices go up)

This was not the case in the USA argues Baker.

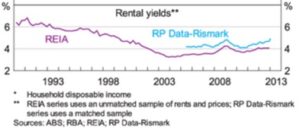

Rents rose largely tied with inflation, which is in contrast to house prices being driven by a shortage of housing supply (ie. buildable land).

He points out that if there were a severe shortage in housing that drove up prices, “then we should expect to see a comparable increase in rents.

As it was, rents were only slightly outpacing the overall rate of inflation in the bubble years.”

The Australian market has rental income increases similar in pace to inflation and has shown no sign of significant increase in recent years.

Reference: https://www.fresheconomicthinking.com/2015/09/

The Population is Growing (increasing demand and prices for housing)

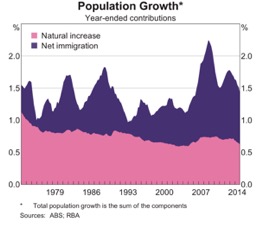

Baker points out that it was well known that the growth of the USA population was suffering a drag due to the ageing of the baby boomers.

“By 2002, baby boomers had largely moved through their years of household formation and were in process of downsizing and preparing for retirement. While Greenspan cited immigration as a factor driving up housing demand, this effect would have been dwarfed by the impact of the aging of the native-born population” says Baker.

Even in hindsight, it’s clear from the graph below that the USA population growth rate was actually decreasing in growth trends from the 2000’s onwards.

Reference: https://www.regiontrack.com/www/pic-of-the-week-slowing-population-growth-becoming-a-concern-for-long-run-u-s-growth-5052014/

For Australia, as this RBA paper highlights, “from 1990 to the mid 2000s, population growth in Australia was relatively low compared with that of the previous two decades, owing to a declining natural rate of population growth and lower net immigration”.

Only in the late 2000’s did it spike with immigration, however the overall growth rates are similar in numbers to the USA overall.

Incomes Are Rising (meaning housing is more affordable.)

To this point, Baker discusses how income growth had been healthy in the late 1990’s, but not extraordinary compared to the 1947-1973 ‘Golden Age’ which led to no increase in house prices that exceeded inflation. By 2002, the economy suffered a recession which resulted in real incomes reducing.

As shown in the graph below, adjusted for inflation (blue line), income growth for the median USA household income was negligible leading up to 2008.

Reference: https://seekingalpha.com/article/4160699-february-2018-median-household-income

In Australia, real income growth has also been either side of inflation. It would be very difficult to argue that wage growth is a direct contributor to rising house prices.

Reference: https://www.businessinsider.com.au/australias-economy-has-grown-for-25-years-but-its-come-at-a-cost-2016-10

Housing Effect upon the Overall Economy

Baker then extends his analysis to show the impact of residential housing prices had upon the USA economy.

These included a high contribution to gross domestic product, record low savings rates and due to an increase in equity within the home consumers bought more goods and services as a result of their new found housing wealth.

All of these macro-economic fundamentals share similar traits in Australia:

Construction Boom

According to LendLease, construction is the largest non-service sector in the Australian economy contributing 8.1% to the national GDP.

Reference: https://tradingeconomics.com/australia/gdp-from-construction

Increased Wealth via Equity in the home

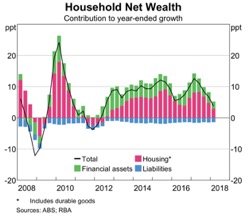

As shown below in the pink columns, wealth has increased due to the rising value of homes.

Reference: https://www.reddit.com/r/AusEcon/comments/9767t3/australian_household_net_wealth_growth/

Personal Savings Rates Reach Record Lows

Reference: https://tradingeconomics.com/australia/personal-savings

Australian Housing & Lending Rules are Different to the USA

There are many variables to extrapolate between the USA and Australia including banking systems, taxation and laws.

Certainly if we compare vacancy rates pre-GFC in the USA, they were much higher than has been the case in Australia. However we do note that vacancy rates in places like Sydney are on the rise.

It’s often raised however that the non-recourse home loan system in the USA was a key contributor to the housing crash.

It is pointed out in Australia that we have a full recourse home loan market, meaning that we cannot walk away from the loan and leave any outstanding balance to the bank once the property is sold – the difference is owed by the borrower.

Academic research has shown this view of the non-recourse borrowing system to be the cause of the GFC to be wrong. The large majority (39 of 50) states in the USA actually have full recourse loans.

Furthermore, Professor Ghent from Wisconsin School of Business analysed the effect that full recourse lending has upon mortgage defaults, “borrowers in non-recourse states are 32 per cent more likely to default than borrowers in recourse states.”

In the ABC news article, Dr Ghent added, “if lenders have full recourse, you may see them making higher LTV (loan-to-value ratio) loans which would tend to increase house price volatility”.

We certainly have witnessed examples of this from the Royal Commission where irresponsible lending claims have been made.

Summary

With falling residential housing prices in 2018 in Australia across many cities, the question arises of whether Australia is perhaps walking in the footsteps of America circa 2008.

Baker concludes in his paper that the lesson from the GFC is the under estimation of risk posed by a bursting house bubble.

Cautionary warnings by the IMF released late February 2019 echo similar issues of high debt with very lofty property prices and the impact upon the overall economy.

For investors, it remains prudent to carefully consider these economic lessons from 2008 and the potential impact it may have upon major Australian asset classes such as residential property in the near future.

This information is for Australian Residents Only. Original Blue Pty Ltd ATF The Reed Family Trust t/as The Retirement Advice Centre is a Corporate Authorised Representative of Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL No. 244252. The views expressed in this publication are solely those of the author; they are not reflective or indicative of Millennium3’s position and are not to be attributed to Millennium 3. They cannot be reproduced in any form without the express written consent of the author. This information (including taxation) is general in nature and does not consider your individual circumstances. You should refrain from doing anything in reliance on this information without first obtaining suitable professional advice. Do not act until you seek professional advice and consider a Product Disclosure Statement.