The Magnificent 7 stocks continue to capture the focus of investors as these large growth names have outpaced the bulk of global equities.

The Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

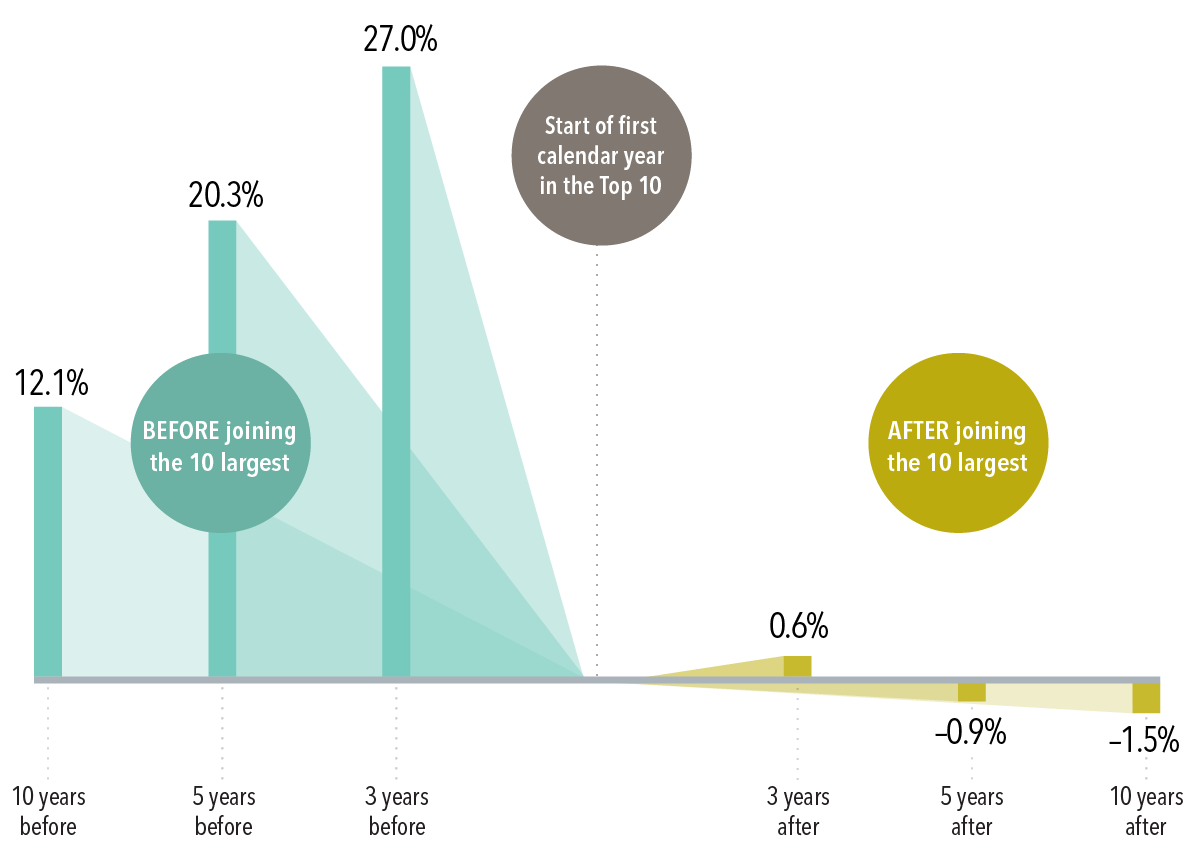

Their outperformance is notable because eye-popping returns for top stocks tend to occur before they reach the top of the market. Once there, subsequent returns tend to lag the market.

This is a cautionary tale for investors expecting continued outperformance from the Magnificent 7.

In fact, rather than seeking additional exposure to these mega cap stocks, investors should ensure their portfolios are broadly diversified to capture the returns of whatever companies ascend to the top in the future.

EXHIBIT 1

View from the Top

Annualised returns in excess of the US market before and after joining the top 10 largest US stocks, January 1927–December 2022

Past performance is not a guarantee of future results.

In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalisation to identify first-time entrants into the top 10.

The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data.

Indices are not available for direct investment. The index has been included for comparative purposes only.

Index Description

Fama/French Total US Market Index: Fama/French Total US Market Research Factor + One-Month US Treasury Bills.

Results shown during periods prior to the index inception date do not represent actual returns of the index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.