By Wes Crill, PhD Head of Investment Strategists and Vice President

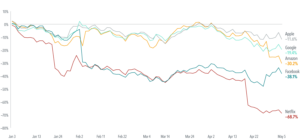

Investors expecting FAANG(*1) stocks to continue the extraordinary performance of recent years must be disappointed by their returns in 2022 (see Exhibit 1). Four of the five stocks lagged the broad US market through May 5, with Amazon, Facebook (now known as Meta), and Netflix suffering big-time losses. The group collectively underperformed the Russell 3000 Index(*2) by nine percentage points.(*3)

EXHIBIT 1

Bite Wounds

Cumulative returns of FAANG stocks, January 1, 2022–May 5, 2022

Past performance is not a guarantee of future results.

This year’s swoon came on the heels of a stellar decade—the FAANGs returned 28.02% per year from 2012 to 2021. Their returns dwarfed the performance of the Russell 3000 Index, which returned 16.3% per year.

This year’s reversal is a reminder that investors should be cautious when assuming past returns will continue in the future. FAANG stock performance in recent years reflected these companies achieving financial success that exceeded most investors’ expectations. That’s in the past, though. Even if these companies sustain their success (and things have been looking gloomy for Netflix!), it may not translate to spectacular future returns. Excellence from the FAANGs may now be the expectation and not the basis for above-market returns.

FOOTNOTES

-

(*1)Facebook-parent Meta; Amazon; Apple; Netflix; and Google-parent Alphabet.

-

(*2)Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Index has been included for comparative purposes only.

-

(*3)FAANG stock returns are computed as the average of Facebook (Meta), Apple, Amazon, Netflix, and Google (Alphabet share classes A and C) weighted by market capitalisation at beginning of month.

DISCLOSURES

Named securities may be held in accounts managed by Dimensional. This information should not be considered a recommendation to buy or sell a particular security.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmitting of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Risks

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA and NEW ZEALAND

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.