Media

Curve Balls

RBA watching is one of the market’s favourite past times. When and what the RBA does next remains to be seen. It might be a good time for a reminder Read more…

Midyear Review: Stocks Maintain Momentum at Year’s Halfway Point

Key Takeaways – US stocks extended a bull market, with the S&P 500 reaching a series of record highs in the year’s first half, led by technology stocks. – Core Read more…

Investing: The Case for Leaving Home

While it’s true that there’s no place like home, when it comes to investing there are costs involved in being too chained to your own patch. Australians and New Zealanders, like investors Read more…

Going for Gold

Gold fever is in the air and it’s not just the prospect of medals at the upcoming Paris Olympics. Gold prices have been climbing strongly in 2024. This is because Read more…

Enjoy the Now and Secure your Future

Managing your financial situation always involves tension between how you live your life now and preparing for your future – whatever that looks like. The worry about not getting the Read more…

Property Investing: Getting it Right

With property remaining a high-priced asset, it’s more important than ever for investors to ensure their property investments are a financial success. The latest data demonstrates property’s popularity. One-in-five households Read more…

How to End the Financial Year on a High Note

As the financial year draws to a close, it’s the perfect time to review your financial affairs and set the stage for a successful new financial year. By taking care Read more…

Winter 2024

With Winter now officially underway, some might be heading north to warm up and others may lean into the cold on the snowfields. Whichever you choose, don’t forget the approaching Read more…

Evidence-based Ways to Hold Back the Hands of Time

You can’t stop the clock, so the saying goes, but humanity has spent a long time trying to slow down or even reverse the effects of ageing. Even today it Read more…

Insurance is a Sound Investment

Managing risk is an essential part of investment strategy to reduce the potential for losses. Risk is not just associated with investing though – life can throw a curve ball Read more…

2024-2025 Federal Budget Analysis

The Big Picture While Treasury is forecasting a $9.3 billion surplus for 2023-24 after the previous year’s $22.1 billion surplus, the books will look considerably different the following year with Read more…

Understanding the new $3m super tax

The much-debated tax on superannuation balances over $3 million is inching closer and those who may be affected should ensure they have considered the implications. Although it is not yet Read more…

Autumn 2024

After a summer of quite extreme weather in many places around Australia, we can hopefully look forward to the cooler, calmer weather that Autumn brings. While economic bright spots can Read more…

The Outsiders

Which stocks are in the indexes you hear about on the financial news every night? Perhaps the more interesting question is which stocks are NOT in the index. Let’s look Read more…

The Rewarding Distribution of Australian Stock Market Returns

Annual stock market returns are unpredictable, but the long history of positive returns may be reassuring to investors who find market downturns unsettling. The graph below shows the rewarding distribution Read more…

Uncertainty Is Underrated

“A wave of new scientific discoveries reveals that learning to lean into uncertainty in times of rapid change is a promising antidote to mental distress.” – Maggie Jackson, New York Read more…

2023: The Year that Wasn’t

At the beginning of the calendar year, there’s a natural tendency in the financial media to look both back and forward – back on the events of the past 12 Read more…

2023 in Review: Defying Predictions

Australia’s economy stubbornly defied predictions during 2023, dashing any hopes that we might begin to return to some kind of normal. Some had expected an end to the Reserve Bank’s Read more…

Powering Down for a Relaxing Holiday

It’s nice to enjoy a break over the summer months. In fact, it’s an Aussie tradition – that mass exodus after Boxing Day that sees us head off for some Read more…

Financial Wellbeing is a Gift Worth Giving Yourself

The festive season is a time of joy and celebration but, for some, it can also lead to a financial hangover in the New Year. Overspending on gifts, parties, and Read more…

How to Give Back

Australia is a giving country, but we often give in kind rather than financially. Whenever there is a disaster here or overseas, Australians rush to donate their time and household Read more…

Summer Summary 2023

It’s December – the month that always seem to race by as we approach the end of the year and all the festivities it brings. We hope you all have Read more…

The Mechanics of ETFs

Exchange traded funds (ETFs) offer investors an efficient means of accessing a professionally managed portfolio of securities through a single investment vehicle. While ETFs share this and many other features Read more…

Long-Term Investors, Don’t Let a Recession Faze You

Investors may be tempted to abandon equities and go to cash when there is a heightened risk of recession. But research has shown that stock prices incorporate these expectations and Read more…

The Power of Compounding – in Health and Wealth

Compounding is one of the most powerful forces in the world. Just ask Albert Einstein, who’s said to have called it the “eighth wonder.” The seemingly small decisions we make Read more…

Aged Care Challenges in the Home

Ageing at home in Australia with government-subsidised funding is made possible through the Home Care Packages program. However, a crackdown on what the funds can be used for and a Read more…

Perspective on Premiums

When you leave your waiter or waitress a tip, do you round it to a whole-dollar amount and often in multiples of $5? Does a 60th birthday seem more significant Read more…

Markets Don’t Wait for Official Announcements

US Recession and Stock Performance During The Global Financial Crisis1 S&P 500 Index, January 2007–December 2010 Some investors may worry about the stock market sinking after a recession is officially Read more…

You Know More about Investing than You Think You Do

No matter how familiar we are with investing, we’ve all navigated uncertainty, weighed risks and rewards, and made carefully considered tradeoff decisions. Just by being human, we’ve been compelled to Read more…

A Positive Property Outlook for Some

Residential property investors have been on a wild ride in recent years as prices slumped during the pandemic then quickly skyrocketed before losing ground again. Now, with prices levelling out Read more…

Destinations to Fire Up your Passions

The world is an amazing place, with so much to see and do. In fact, sometimes it can feel as though there is so much to experience so it can Read more…

How the Aussie Dollar Moves your Investments

It has been a wild ride for the Australian dollar since the Covid-19 pandemic struck and that could mean good news or bad news for your investment portfolio. In March Read more…

Should I Buy Insurance through my Super?

While we all hope for good health, the reality is that some of us may struggle at times with sickness or injury. And that may affect your family’s financial wellbeing. Read more…

Spring 2023

September is upon us, and spring is in the air. It’s time to shake off the winter cobwebs, get out into the garden or the great outdoors. Meanwhile, AFL and Read more…

David Booth in the Financial Times: Why the Wisdom of the Market Crowd Beats AI

This piece was written by David Booth, Chairman and Founder of Dimensional and was originally published in the Financial Times. Can artificial intelligence help pick stocks? More specifically, can investors Read more…

Expectations vs. Reality in Value Funds

Key Takeaways – Strategies with the most value exposure tend to outperform when value is strong. But many investment managers who target value fail to fully capture the premium. – Read more…

Cracks in the Crystal Ball

Key Takeaways – At the turn of the financial year, the media is filled with articles making forecasts for the economy and markets in the coming 12 months. – An Read more…

How Iron Ore Plays a Big Part in our Economy

Iron ore has been the backbone of the Australian economy and many investment portfolios for much of the 21st century. Export of the commodity saw Australia evade recession both in the Read more…

Mind over Matter: Perspective for Investors on the US Debt Ceiling

Key Takeaways – The debt ceiling is the amount of money Congress has authorised the government to borrow. The ceiling has been raised 78 times since 1960. – It’s not Read more…

From Skynet to ChatGPT: AI and Its Investment Implications

If you were to poll strangers on what comes to mind when they hear the term AI (artificial intelligence), I suspect the two most likely answers would be Skynet or ChatGPT. The Read more…

Midyear Review: Staying Focused as Markets Shift

Key Takeaways – Stocks rebounded from their worst year since 2008, returning to a bull market in the US. – Inflation fell to half of last year’s peak, and the Read more…

Will These Super Changes Affect You?

As our superannuation balances grow larger, it makes more sense than ever to keep track of the many rule changes that have recently happened or are coming up soon. Australians Read more…

Sowing the Seeds for a Happy Retirement

The thought of retirement is an enticing one for many of us. Imagine throwing off the shackles of the workforce and being able to do whatever you want, whenever you Read more…

Who Needs a Testamentary Trust?

The rising cost of living is grabbing all the attention right now as people struggle to pay increasing prices. But in the meantime, our collective wealth has been growing steadily Read more…

Set Yourself up for Success in the New Financial Year

The start of a new financial year is the perfect time to get your financial affairs in order. Whether it’s tidying up your paperwork, assessing your portfolio or dealing with Read more…

Winter 2023

As winter sets in and the end of the financial year approaches, it’s a good chance to spend some time tidying up and reviewing your finances. Many factors have affected Read more…

How Targeting Size, Value and Profitability Can Improve Retirement Outcomes

Key Takeaways – Broadly diversified equity portfolios with a moderate emphasis on size, value and profitability can help increase retirement assets. – This investment approach can also sustain retirement income Read more…

The Stock Market vs. Stocks in the Market

The collapse of First Republic Bank is a harsh reminder that any stock can go to zero, no matter how established a company is, or how loyal and wealthy its Read more…

Federal Budget 2023-24 Analysis

A Surplus For Now But Stormy Seas Ahead Treasurer Jim Chalmers bills his 2023 Federal Budget as an economic strategy to help ease cost-of-living pressures. To that end, he has Read more…

When Headlines Worry You, Bank on Investment Principles

On Friday, March 10, regulators took control of Silicon Valley Bank as a run on the bank unfolded. Two days later, regulators took control of a second lender, Signature Bank. Read more…

What’s Your True Net Worth?

Many apps today claim to instantly calculate your net worth by adding up your banking and investment accounts and then deducting what you owe on your credit cards and mortgage. Read more…

Hoop Dreaming Is Fun in March. Investing Realities Apply Across a Lifetime.

Every year at this time, the NCAA men’s basketball tournament thrills fans and creates so much interest that it’s estimated one in four Americans filled out a bracket (a tree Read more…

How Do Interest Rates Affect Your Investments?

Interest rates are an important financial lever for world economies. They affect the cost of borrowing and the return on savings, and it makes them an integral part of the Read more…

Trust your Gut to Boost your Health

Gut health has become one of the hottest health topics in recent years as we have started to learn about the complex connection between gut health and overall health. So Read more…

Star Ratings for Aged Care Help Make Family Choices Easier

Moving into aged care can be a challenging time, both for those making the move and families supporting their loved ones. It’s understandable that everyone wants to find the most Read more…

Flexing your Retirement Plans

The concept of retirement is changing, with fewer people working towards a final retirement date and then clocking off for good. Instead, those who have the flexibility to choose are Read more…

Autumn 2023 Snapshot

With Autumn underway, the changing season is a reminder to take stock and prepare for what’s ahead as the financial year heads towards its final quarter and the May Federal Read more…

Two Steps Forward, One Step Back for Investors

Consider everything investors have been through in recent years: a global pandemic, rapid inflation, war in Europe and volatile stock and bond markets. It’s reasonable to feel uneasy in the Read more…

People Have Memories. Markets Don’t.

One of the best things about markets is that they don’t have memories. They don’t remember what happened last week or last year. Like a goldfish, they don’t even remember Read more…

Volunteering: Find Your Purpose and Give Back to Your Community

Retirement is a time of great change and transition. You may find yourself looking for new ways to engage with your community and find a sense of purpose. Volunteering can Read more…

8 Retirement Mistakes and How to Avoid Them

Retirement is a phase of life most of us look forward to. It’s a chance to pursue other interests, travel and maybe do some part-time work or volunteering. Thanks to Read more…

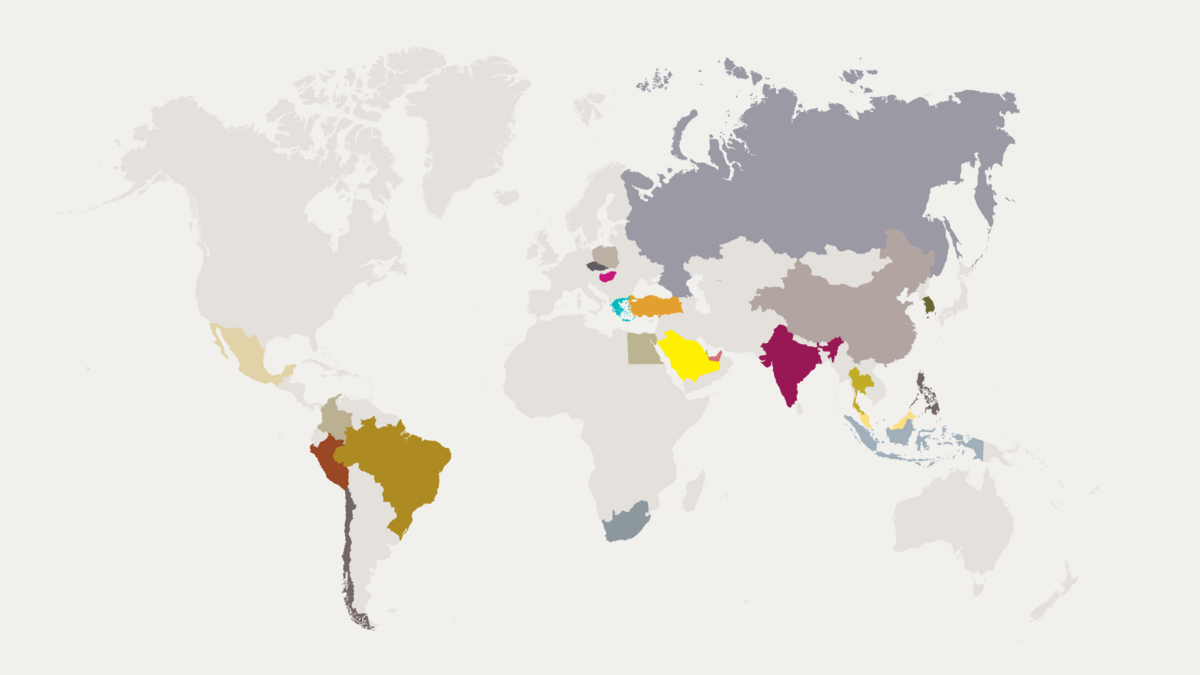

Ins and Outs of Emerging Markets Investing

Recent history reminds us that emerging markets can be volatile and can lag developed markets. However, emerging markets represent a meaningful piece of the global investment opportunity set. A disciplined Read more…

This Has Been a Test: Developing a Financial Plan You Can Stick With

Think back to December 2019. The economy was humming. Unemployment, interest rates and inflation were at historically low levels. But then what happened? – A global pandemic hit. By the Read more…

Market Review 2022: After a Down Year, Looking to the Past as a Guide

Key Takeaways – Stocks had their worst year since 2008, and bond prices also fell as inflation reached a four-decade high. – Value stocks served as bright spot, outperforming growth Read more…

2022 Year in Review

The year began on an optimistic note, as we finally began to emerge from Covid restrictions. Then Russia threw a curve ball that reverberated around the world and suddenly people Read more…

The Year that Wasn’t

As an eventful year in markets nears its close, analysts are being asked about their expectations for 2023. The media uses these surveys to generate eye-catching headlines, but rarely does Read more…

Celebrating the Festive Season, the Aussie Way

If you’ve ever hosted a visitor from overseas during the festive season, you may have seen them a little bemused by the way we celebrate. It’s quite understandable, as we Read more…

Buying Shares for Kids: a Gift that Keeps on Giving

Many parents and grandparents worry about how to help the children in their lives achieve financial independence. But the value of long-term investment can seem like a dry and complicated Read more…

Sustainable Investing on the Rise

Sustainable investing isn’t new and is becoming more mainstream. From climate change to gender diversity, more people are aligning their money with their values. In 2021, Australia’s sustainable investment market Read more…

Summer Summary 2022

It’s December already! Summer is here and holidays are just around the corner. We take this opportunity to wish you and your family a happy festive season. The big story Read more…

Go Global for Diversification That Travels Well

Australian investors may believe they know Australia best. Accordingly, they are liable to put the bulk of their investments in stocks and bonds of Australia-based companies and in Australian government Read more…

Information Hygiene

The pandemic showed the power of a previously unknown virus to spread through the global population, threatening health and creating economic mayhem. But few people appreciate the power of bad Read more…

Rate Expectations

If you consume enough financial media, you’ll notice that much time and space is spent wondering what central banks will do next with benchmark interest rates. But while this constant Read more…

Federal Budget Analysis 2022 – 2023

Budget October 2022: sign of the times In his first Budget, Treasurer Jim Chalmers emphasised the three R’s – Responsible budget repair and Restrained spending, Right for the times. For Read more…

Bad Medicine: The Problem with Poison Pills

Key Takeaways – Market volatility can lead companies to adopt poison pills in an effort to block hostile takeover attempts. – The market for corporate control, including hostile takeovers, can Read more…

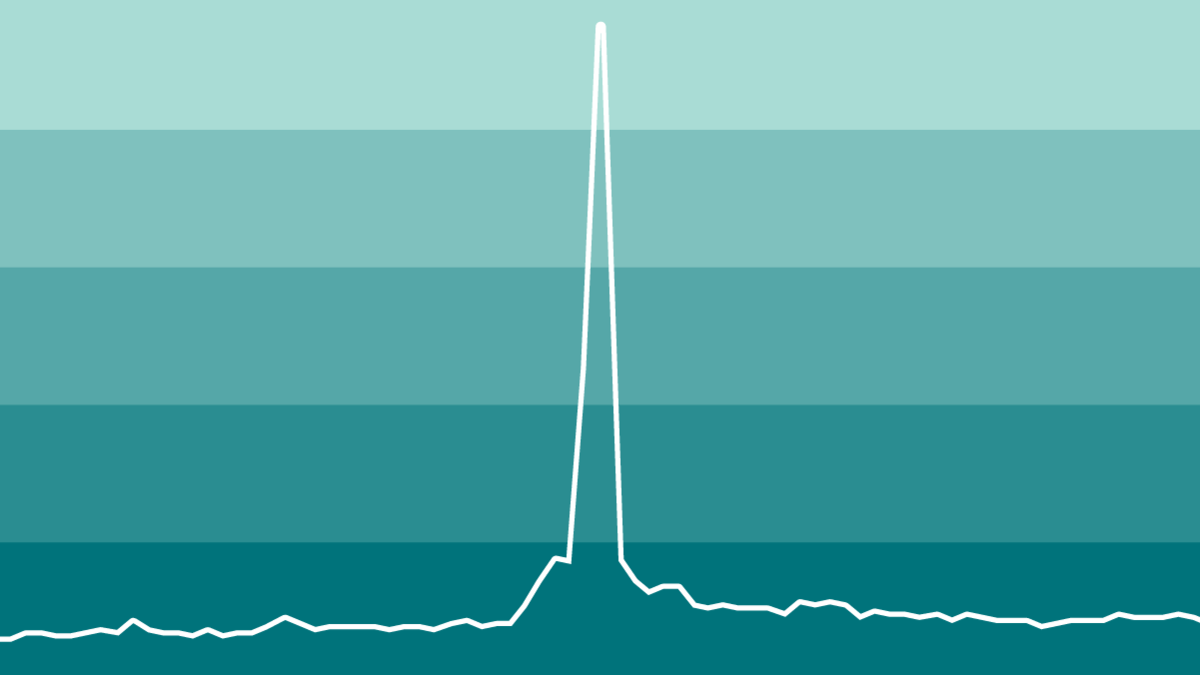

The Cost of Trying to Time the Market

Missing only a brief period of strong returns can drastically impact overall performance. S&P/ASX 300 Index (Total Return)(*1) The impact of being out of the market for a short Read more…

How to Invest Better and Live Better

By David Booth Executive Chairman and Founder of Dimensional. It can be challenging to start a conversation about investing. That’s why I encourage having a conversation before the investing conversation Read more…

A Guide to Aged Care at Home

As we get older, most of us want to remain independent and in our own home for as long as possible. But this can be challenging without some help with Read more…

Mortgage Vs Super

“Should I put my money into my mortgage or my super?” With interest rates on the rise and investment returns increasingly volatile, Australians with cash to spare may be wondering Read more…

Go on… Take a Break!

One of the things many of us have been missing over the past few years is holidays… Now that the world is opening up again for travel and destinations that Read more…

How is my Insurance Taxed?

With the cost of living on the rise, it’s more important than ever to have a financial safety net that protects you and your family in case the unexpected happens. Read more…

How Much Super Do You Need to Retire?

Working out how much you need to save for retirement is a question that keeps many pre-retirees awake at night. Recent market volatility and fluctuating superannuation balances have only added Read more…

What Drives Investment Returns? Start with Ingenuity

A recent news item reported that Frederick Smith intended to step down as Chairman and Chief Executive Officer of FedEx Corp., the largest air freight firm in the world. As Read more…

Liquid Alternatives: Panacea, or Just a Pain?

Key Takeaways – Liquid-alt investments claim they deliver higher potential returns and lower correlations to stocks and bonds – but have fallen short. – From June 2006 to June 2022, Read more…

World Cup of Investing

While the All Blacks are one of the world’s most successful sports teams, Kiwi rugby fans have learnt not to expect them to win the World Cup at every tournament. Read more…

Back to the Futures: A Look at US Federal Funds Futures and Bond Performance

Key Takeaways – Federal funds futures reflect market expectations about future changes in the federal funds rate. – Using data starting in 1989, we find no reliable relation between expected Read more…

Making Cash Flows Count

Key Takeaways – Dimensional makes buy and sell decisions every day based on numerous inputs. – This process allows us to use available proceeds on a targeted subset of Read more…

The Rewarding Distribution of Australian Stock Market Returns

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in Australia. That may be reassuring to investors, especially if they find market Read more…

The Difference Between a Forecast, a Wish and a Worry

By David Booth, Executive Chairman and Founder of Dimensional. When I was growing up, our local newspaper, the Kansas City Star, was full of news and had one page for Read more…

Does [fill in the blank] Belong in My Portfolio?

Key Takeaways – A general framework based on potential benefits and drawbacks can be used to assess the merits of a new investment opportunity. – A sensible approach is to Read more…

Riding Out the Storm: Seven Lessons

Two years since the pandemic shock helped drive global share markets down 30-40% in the space of weeks, volatility is back. This time, however, it’s war, inflation, and recession fears Read more…

Beware the Hidden Costs of Indexing

Key Takeaways – A Dimensional study shows that there are potential hidden costs associated with rigidly following an index. – The stocks that make up index funds can see increased Read more…

Robert Merton on Australia’s Retirement System

Nobel laureate Professor Robert Merton is one of the world’s leading thinkers on retirement systems. Professor Merton has laid out a comprehensive proposal for how Australia’s superannuation industry might manage Read more…

A Super Window of Opportunity

New rules coming into force on July 1 will create opportunities for older Australians to boost their retirement savings and younger Australians to build a home deposit, all within the Read more…

Worried About Stocks? Why Long-Term Investing Is Crucial

Article by David Booth, Dimensional Executive Chairman and Founder. We are living in a time of extreme uncertainty and the anxiety that comes along with it. Against the backdrop of Read more…

A Super End to the Financial Year

As the end of the financial year approaches, now is a good time to check your super and see what you could do to boost your retirement nest egg. What’s Read more…

Tips to Navigate Market Volatility

The best thing investors can do when markets are volatile is to stay invested. Of course, that’s often easier said than done, especially when market commentators point to a market Read more…

How to Manage Rising Interest Rates

Rising interest rates are almost always portrayed as bad news, by the media and by politicians of all persuasions. But a rise in rates cuts both ways. Higher interest rates Read more…

Sharing Super a Win-Win for Couples

Australia’s superannuation system is based on individual accounts, with men and women treated equally. But that’s where equality ends. It’s a simple fact that women generally retire with much less Read more…