Due to the Coronavirus pandemic, the Australian Federal Government has embarked upon a number of measures to offer economic relief packages to help Australians through this period.

Recently, theHomeBuilder scheme was announced to stimulate the building industry, create jobs and economic growth, and for those able to take advantage, provide the opportunity to build or renovate the home of your dreams.

What is the HomeBuilder scheme?

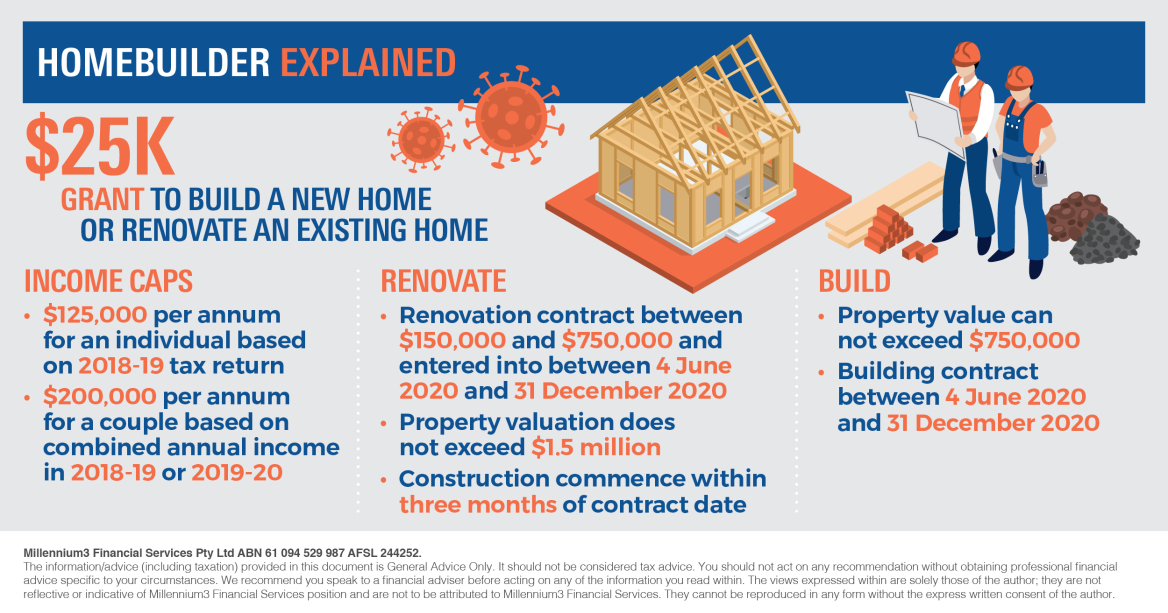

HomeBuilder provides eligible owner-occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home.

This is on top of any other State or Territory initiatives, such as stamp duty concessions and the Commonwealth’s First Home Loan Deposit Scheme and First Home Super Saver Scheme.

This means you could double-up on benefits.

For some who may have lost their homes in the recent bushfires that ravaged homes particularly in New South Wales and Victoria, or have been trying to get into the property market, it is worth looking into the HomeBuilder scheme to determine whether you are eligible to take advantage of this one-off opportunity.

Who is eligible?

There are certain criteria you must meet, such as being a person (rather than a company or trust), are aged 18 years or older, and an Australian citizen. Other eligibility requirements include:

> meeting one of the following two income caps of $125,000 per annum for an individual applicant based on your 2018-19 tax return or later; or $200,000 per annum for a couple based on both 2018-19 tax returns or later

> entering into a building contract between 4 June 2020 and 31 December 2020. This contract must be to build a new home as your principal place of residence, where the property value does not exceed $750,000, or you must contract a builder to substantially renovate your existing home as your principal place of residence, where the renovation contract is between $150,000 and $750,000, and the value of your existing property does not exceed $1.5 million

> construction commencing within three months of the contract date

Applying for HomeBuilder

You will be able to apply for HomeBuilder when the relevant State or Territory Government that you live in, or plan to live in, signs the National Partnership Agreement with the Commonwealth Government.

When the States and Territories begin accepting HomeBuilder applications, they will backdate acceptance of these applications to 4 June 2020.

Other recent schemes to keep in mind

Relief packages to help small business survive and bounce-back from the Coronavirus pandemic include:

> JobKeeper payment – this measure will cease on 20 July 2020 for childcare services but continue for other eligible small businesses until 27 September 2020.

> the easing of restrictions – with the pandemic remaining under control, for now, the Government has announced an easing of restrictions to allow many small businesses to open, albeit at a reduced capacity and with increased hygiene measures.

> a National COVID-19 Coordination Commission has been established and they have developed a planning tool for small businesses to utilise in order to operate under conditions that keep them, their customers and their employees safe.

Talk to your financial adviser

Whilst you may be keen to jump straight into this offer, it is important to remember that in building or renovating, you are parting with a large sum of money, and most likely signing up to a large loan or mortgage.

As this is a big financial decision, talking to your financial adviser can help you work out how this fits into your overall financial plan.