EXECUTIVE SUMMARY

The COVID-19 pandemic has been a defining event for this generation. People’s livelihoods, social habits and outlook have been irrevocably changed by the pandemic and the response by governments around the world.

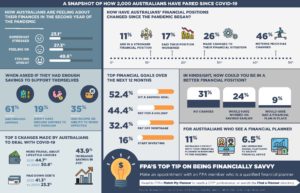

In Australia, the pandemic has served as a wake-up call to many Australians about how they manage their finances and how to prepare better for a future marked by the shadow of further outbreaks and ongoing effects on society. Nearly one in four people said they were somewhat stressed by their financial situation, and 17% said their situation had worsened in the past 12 months.

COVID-19 IMPACT:

HOW BEHAVIOUR CHANGED

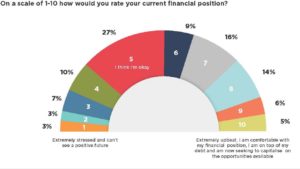

The research highlights the different impact of the pandemic across society. On the spectrum of responses to the question about people’s financial circumstances 23% were somewhat stressed and 27% felt OK about their circumstances.

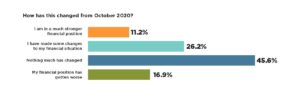

In keeping with other research on the disproportionate impact of the pandemic on women’s work and home lives, the survey revealed women were more negative than men about the financial effects (27% vs 20% somewhat stressed and 30% vs 24% feeling OK). Men were more buoyant (50% vs 43%) and this carried over to their verdicts on what had changed in 12 months: 14% of men felt they were in a much stronger position, compared to 9% of women, and 15% of men felt in a worse position against 19% of women.

Financial stress was equally felt across age groups, although a little more among 55-59 year olds. Older generations were also the most likely to say nothing had changed in their circumstances since last year – the majority of 50-65 year olds. Those aged 30-39 were the least likely to say their situation was unchanged and the most likely to say they had made some changes to their financial arrangements.

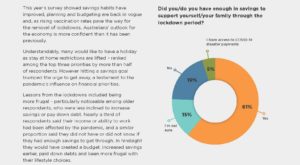

Encouragingly, Australians have stayed focused on their new financial habits 12 months on from the last survey. Behavioural changes that were revealed last year have strengthened, as people prioritise being more frugal about their lifestyle choice (44.7% in 2021 vs 30.8% in 2020); increase their savings (43.9% in 2021); focus on paying down debts – including mortgage and credit card debt – (41.3% in 2021 vs 23.3% in 2020); and creating a budget to understand what they are spending and saving (38.6% in 2021 vs 23.2% in 2020).

Again there were differences, with more women than men inclined to set a budget and reduce frivolous spending, but the gender balance reversed when it came to actions such as topping up super, increasing savings, increasing health insurance coverage and investing more outside super. Those 30-34 years old showed the highest propensity to make changes in response to the pandemic – particularly budgeting and saving – but were the least inclined to be more frugal about their lifestyle choices.

PRIORITIES:

WHAT WOULD YOU DO DIFFERENTLY?

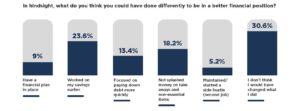

Looking back on what they could have done differently to put themselves in a better financial position, nearly one third of respondents said they would not have changed anything. But there was still 69% of respondents who said they would have made changes, headed by 24% who said they would have started working on their savings earlier. Another 18% said they would have splashed less on takeaway food and non-essential items, while 13% would have paid off debt earlier. Another 9% said having a financial plan in place would have helped while just 5% said they would have started or maintained a side hustle to grow their income.

More men indicated they would have had a financial plan in place, whereas more women have indicated not splashing as much money on takeaways and non-essential items.

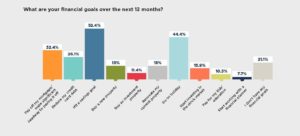

When it came to goals for the next 12 months, respondents were not quite evenly split between the lessons of hindsight – hit a savings goal – and the desire to take a holiday after 18 months of limited freedoms. More than half of respondents said that hitting a savings goal is priority. That goal is shared by men and women but is strongest in those aged 30-44.

Holidays were a consistent desire across the ages and sexes, nominated by 44% of total respondents, making it the second top priority.

Among the lesser priorities there were differences, however. More men than women want to buy a new property or an investment property and – after seeing share prices around the world scale new heights through the pandemic – start investing in the stock market. Women preferred renovating and paying for their children’s education.

FINANCIAL ADVICE: ATTITUDE, IMPACTS, TIPS

Australians retain a strong DIY mentality when it comes to their finances, going by the responses to the survey, with 41% answering that they did not have a financial accountability partner because they could only trust themselves with their finances. Another 47% nominated their spouse as their financial accountability partner.

Still, 12% of people said they used a financial planner and another 9% said they had used one in the past, planned to engage one or used a robot advice platform.

Among those who are using advice, those aged 30-39 were the most likely to have increased engagement, either because they needed reassurance or a financial plan or because they were maximising use of digital platforms.

Older generations – 50 to 65 – were the most likely to say their engagement was unchanged.

For those who don’t use advice, more than a third believed they did not need it and could do it themselves.

Another 15% said they did not think they could afford it – a sentiment particularly strong among women, and another 12% said they did not think they had enough assets or investments to justify it. Use of digital advice was particularly strong among men (9% vs 4%) and among those aged 30-39 years.

Perhaps most encouraging for the profession, 13% of people said they were considering engaging an adviser now.

ABOUT THE RESEARCH

This research undertaken by the FPA (Financial Planning Association) provides a snapshot of how Australians view their personal finances and the steps they take to manage their affairs. It was researched and written with much of the East Coast still under lockdown to combat the Delta variant of COVID-19, but with rising vaccinations providing a clear path back to those restrictions being lifted.

It reveals that around a third of Australians had their income or ability to work affected by lockdowns, and that almost a fifth of Australians did not have enough in savings to support themselves through that period. But it also highlights that many Australians have used the pandemic to reconsider their finances – spending and saving habits, budgeting and planning – and have an appetite to make changes.

The pandemic has been a sharp reminder for everyone to have a financial plan in place, not only as a road map to achieve their goals, but also as a contingency for unforeseen events. Research findings show there has been an increase in Australians seeking professional financial advice and having a financial plan in place.

In August and September 2021, the FPA surveyed 2,005 Australians to discover how the COVID-19 pandemic and consequent economic lockdowns had affected their work, income, financial habits and outlook. The research was undertaken by Pureprofile at a time when governments around the country had agreed a roadmap out of lockdowns as the primary response to the pandemic.

Instead, stepped vaccine rates would restore incremental freedoms to people in most states who have been subject to strict stay at home regimes. FPA urges citizens to treat their financial wellbeing with the same attitude they treat their health or professional concerns. Seek advice, set a plan, establish good habits and check in regularly to make sure you are on track.

Call us for a comprehensive, personalised plan today on 1300 78 55 77.

Reference:

Financial Planning Association of Australia. Money and Life Tracker, p. 12. Retrieved from https://fpa.com.au/about/financial-planning-magazine/