Exchange traded funds (ETFs) offer investors an efficient means of accessing a professionally managed portfolio of securities through a single investment vehicle.

While ETFs share this and many other features with managed funds, the process of buying and selling ETF units is different.

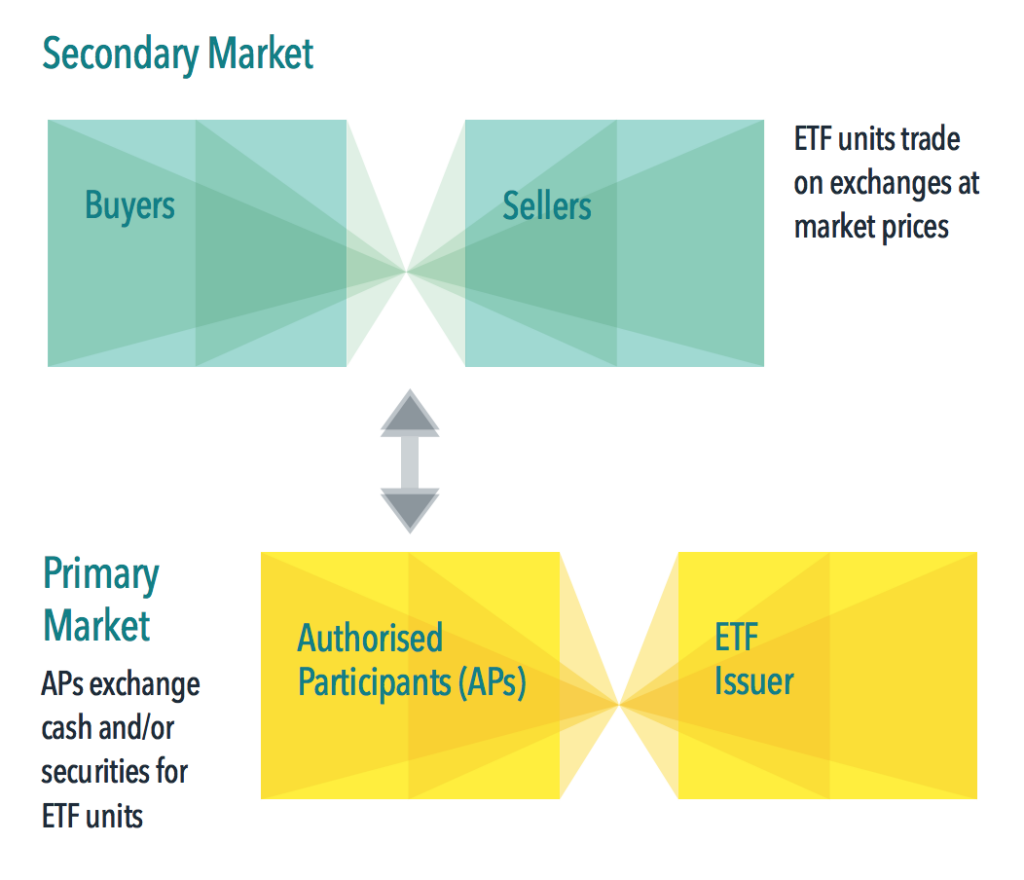

Similar to trading a stock, investors can buy and sell ETF units on a stock exchange at a market price that can change throughout the day. These trades occur on the secondary market.

New units of an ETF are created when an ETF issuer, such as Dimensional, and an approved financial institution, referred to as an Authorised Participant (AP), transact in the primary market.

When there is high demand for ETF units, an AP can request new units from the ETF issuer in exchange for securities and/or cash.

To redeem units of the ETF, the AP can deliver ETF units to the ETF issuer in exchange for securities and/or cash.

This plays an important role in balancing the supply and demand for units of an ETF.

ETF trading across primary and secondary markets helps support the daily demand for ETF units, providing multiple layers of liquidity to investors.1

Definitions

Primary Market: The market for creating new or redeeming existing ETF units, which is facilitated by trades between an authorised participant and an ETF issuer.

Secondary Market: The market where previously issued ETF units are bought and sold, often on exchanges.

1Multiple layers of ETF liquidity refers to liquidity available in the secondary market and that can be generated in the primary market through ETF unit creation and redemption activity between APs and an ETF issuer. This is unlike an individual stock, which generally has a fixed supply of shares in the secondary market. An AP may request to create or redeem ETF units in order to provide liquidity to large ETF orders or to help balance supply and demand for ETF units on the secondary market.

Disclosures

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change