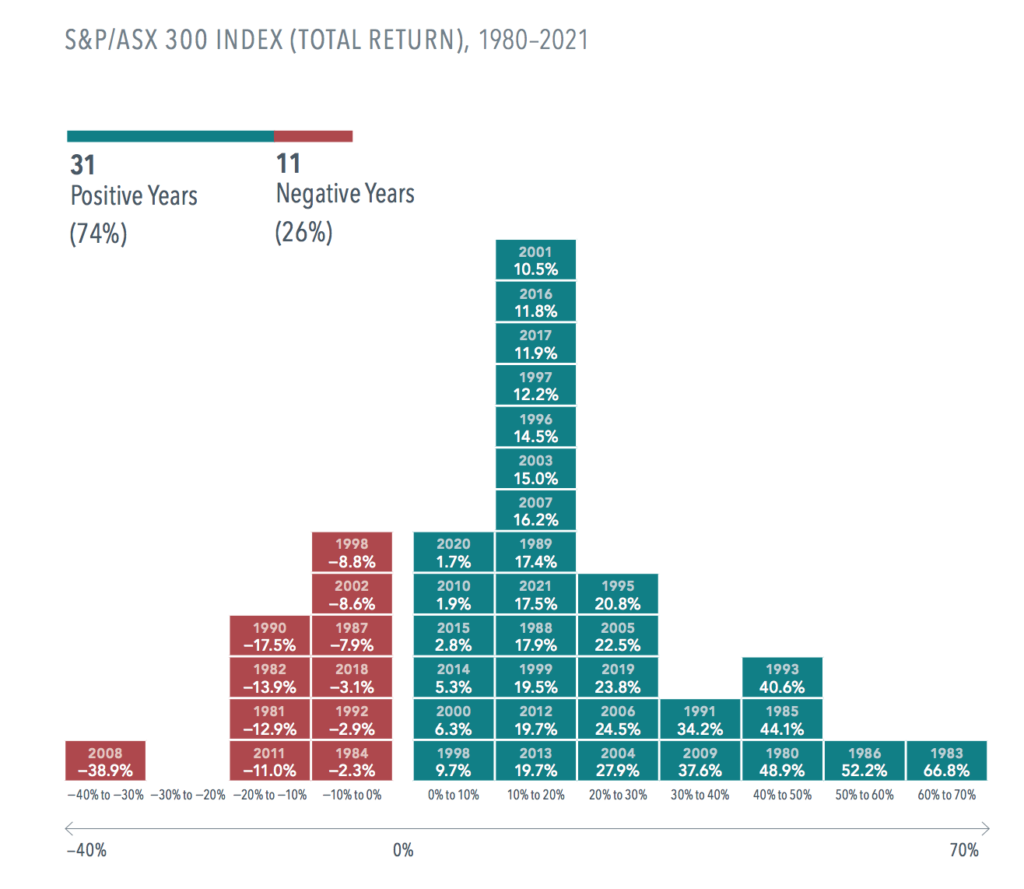

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in Australia.

That may be reassuring to investors, especially if they find market downturns unsettling.

• The Australian stock market posted positive returns in 74% of the calendar years from 1980 through 2021.

• The market gained an annualised average of 11.1% during this period. Yet nearly two-thirds of yearly observations were at least 10 percentage points above or below the average.

• Another noteworthy trend: More than 90% of the down years were followed by up years. The most recent example: a 3.1% loss in 2018 followed by a 23.8% gain in 2019.

The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

DISCLOSURES

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In AUD. S&P/ASX data copyright 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. AUSTRALIA This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.