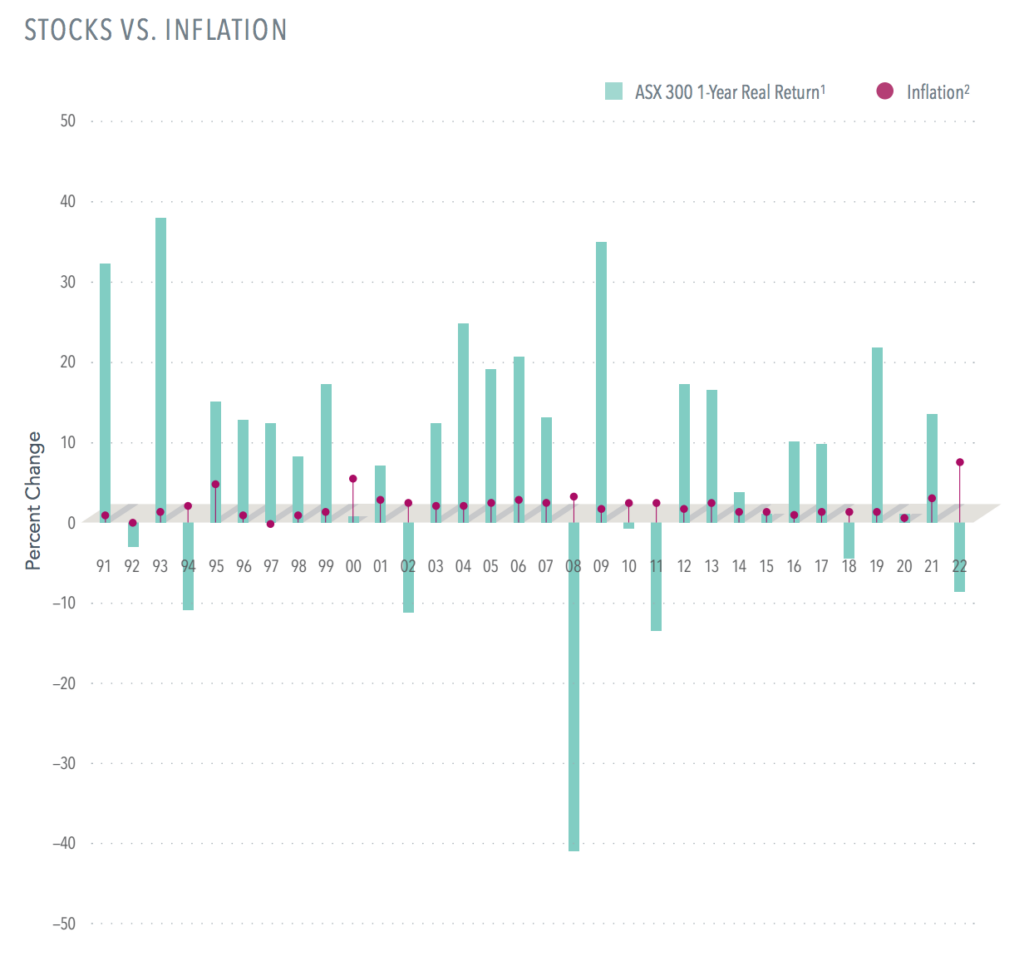

Here’s some good news: Inflation isn’t necessarily bad news for stocks.

– A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and Australian stock returns.

– Since 1991, one-year returns on stocks have fluctuated widely. Yet the weakest returns can occur when inflation is low, and 24 of the past 32 years saw positive returns even after adjusting for the impact of inflation.

– Over the period charted, the ASX 300 posted an average annualised return of 7.32% after adjusting for inflation. History shows that stocks tend to outpace inflation over time—a valuable reminder for investors concerned that today’s rising prices will make it harder to reach their long-term financial goals.

Logic and history support a commitment to value stocks so investors can be positioned to take part when those shares outperform in the future.

Footnotes

1. Real returns illustrate the effect of inflation on an investment return and are calculated using the following method:

[(1 + nominal return of index over time period) / (1 + inflation rate)] − 1. S&P/ASX data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

2. Based on non-seasonally adjusted 12-month percentage change in Consumer Price Index for All Items in Australia.

Source: Australian Bureau of Statistics.

Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.