Key Takeaways

– Federal funds futures reflect market expectations about future changes in the federal funds rate.

– Using data starting in 1989, we find no reliable relation between expected changes in the fed funds rate and either future bond returns or future term premiums.

Between March 2022 and June 2022, the US Federal Reserve raised the policy rate – the federal funds target rate – three times, by a total of 150 basis points.

This rapid and substantial interest rate hike has introduced significant volatility to global bond markets. Many investors have been asking whether they should adjust their fixed income investments based on past rate hikes and the anticipation of future rate hikes.

Now we explore the relation between investors’ expectations of federal funds rate changes and future bond performance.

To study this, we must first come up with a reasonable measure for the expected federal funds rate. Since we cannot peek into the future like in the eponymous movie, we use the closest to a crystal ball we have – current market prices.

Federal funds futures capture market participants’ aggregate expectations of the future evolution of the federal funds rate, and their prices are available for empirical research.

Roads? Where We’re Going, We Only Need Futures

Federal funds futures are liquid monthly futures contracts that investors use to bet on or hedge against short-term interest rate fluctuations.

Their prices are directly linked to the daily effective federal funds rate over a calendar month.(1)

For example, the June 2022 federal funds futures contract, which settled on July 1, 2022, had a settlement price based on the average daily effective federal funds rate of 1.21% for the month of June. Hence the price on a federal funds futures contract reflects the expected average federal funds rate for its settlement month.

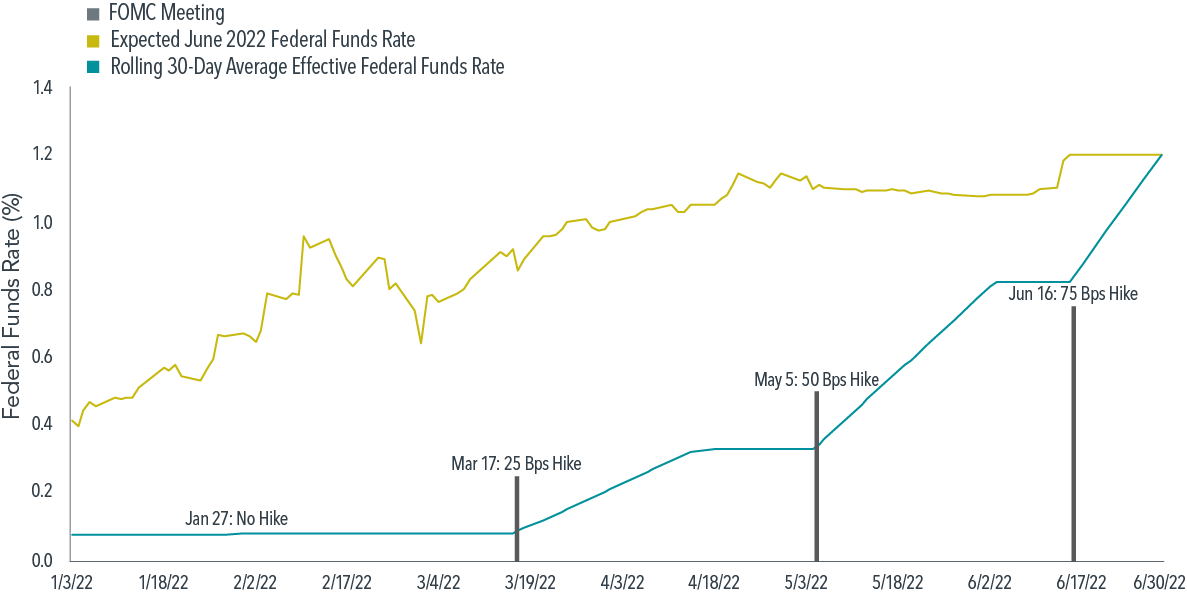

Exhibit 1 shows the expected federal funds rate for June 2022 has evolved throughout the first half of 2022, as the market has incorporated a lot of new information about the macroeconomy and geopolitics.

In particular, we see the market expectation of the June 2022 federal funds rate increased before each of the four Federal Open Market Committee (FOMC) meetings during the period, which suggests the market was pricing in the Fed’s possible monetary policy actions ahead of time.

As the contract expired, the expected June 2022 federal funds rate and the rolling 30-day average of daily effective federal funds rate converged, consistent with the contract’s settlement convention.

EXHIBIT 1

Expectations of Change over Time

Evolution of expected federal funds rate for June 2022

We can use prices of federal funds futures contracts for consecutive months to construct a term structure of the expected federal funds rate. We focus on the term structure over the next 12 months as the corresponding futures contracts are actively traded.(2)

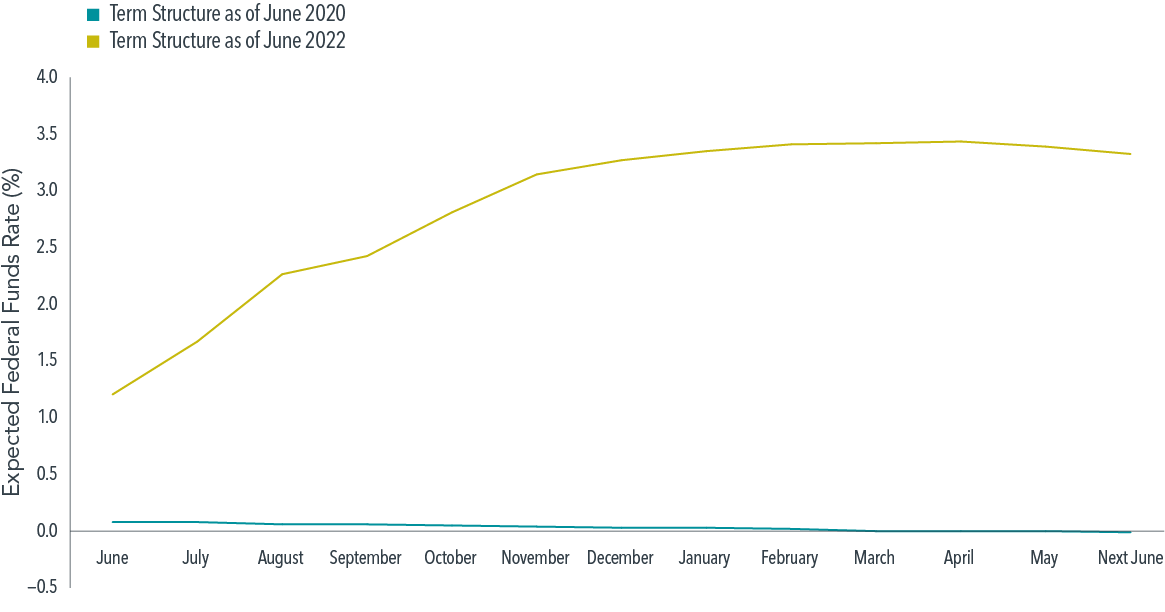

Exhibit 2 shows two examples of term structures: the flat term structure as of June 2020 indicates low chances of a rate hike due to pandemic-related uncertainties. The the upward-sloping term structure as of June 2022 indicates the market expects a higher federal funds rate in the future.

As of June 30, 2022, the average federal funds rate for June 2022 was 1.21%, and the expected (average) federal funds rate for July 2022 was 1.67%.

We define the expected change in the (average) federal funds rate between June and July 2022 as the difference between these two rates. This difference reflects the market expectation that there would be a further rate hike in the FOMC meeting scheduled on July 27, 2022, and can be used to calculate the implied probabilities and the expected level of rate hike on that date.

Based on CME FedWatch’s methodology and the June-July federal funds futures price difference, the most likely outcome for the July FOMC meeting would be a rate hike of 75 basis points, with a probability of 83%.(3)

[UPDATE: On July 27, the US Federal Reserve officially increased the federal funds target rate by 75 basis points.]

EXHIBIT 2

Federal Funds Futures Term Structure

Term structure of expected federal funds rate as of June 2020 and June 2022

Futures and Future Bond Returns

We can use the shape of the term structure of the expected federal funds rate to examine the relation between the expected change in the federal funds rate and the next-month returns on government bonds in excess of cash.(4)

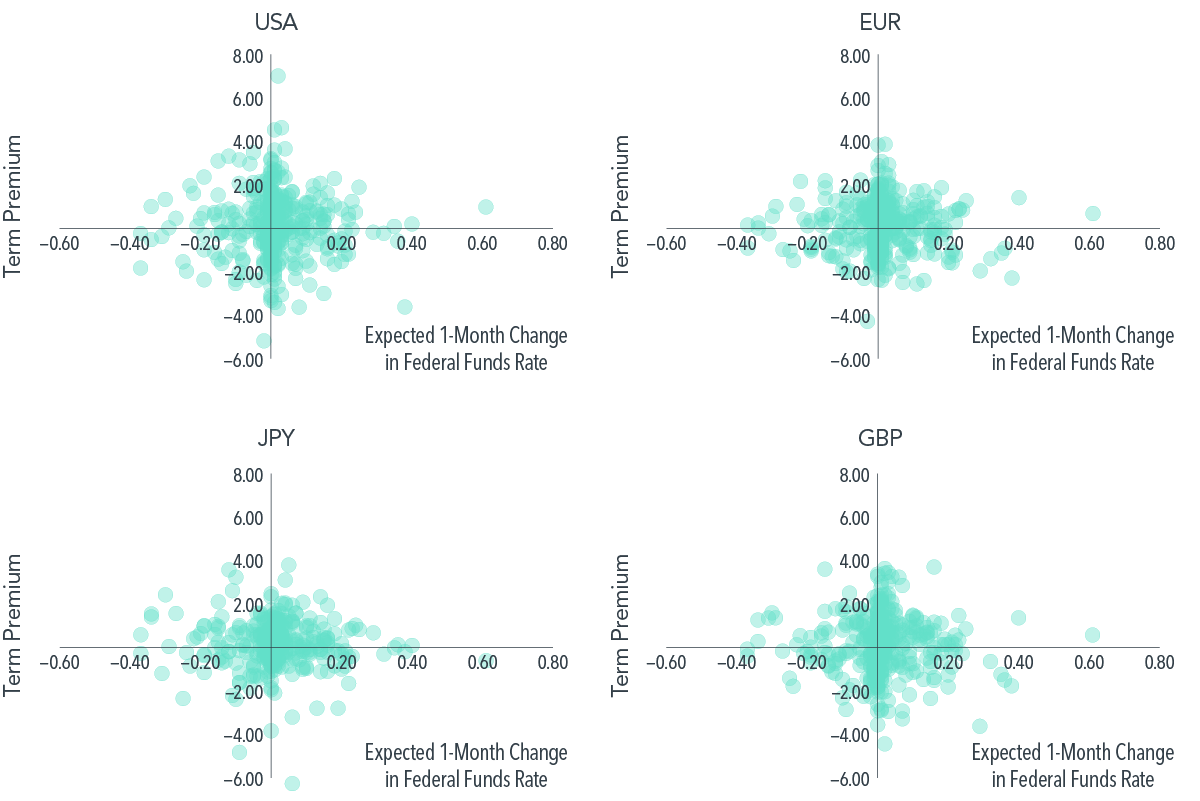

Exhibit 3 charts the expected 1-month change in federal funds rate at the beginning of each month from January 1989 to June 2022 (horizontal axis) vs. monthly USD-hedged government bond excess returns (vertical axis) for the US dollar (USD), the euro (EUR), the yen (JPY), and the British pound (GBP).(5)

Across the four currencies, we find no reliable relation between the market expectation of the federal funds rate change over a month and government bond performance in the subsequent month.

This result is robust if we replace the expected 1-month change in the federal funds rate in the analysis with the expected 3-month, 6-month, or 12-month change in the federal funds rate. Therefore, for long-term investors, our analysis does not support the idea of allocating away from bonds to cash in response to expected hikes in the federal funds rate.

EXHIBIT 3

Federal Funds Futures and Government Bond Excess Return

Global government bond monthly returns in excess of cash (%) vs. expected 1-month change in federal funds rate at beginning of month (%), January 1989–June 2022

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. FTSE fixed income indices © 2022 FTSE Fixed Income LLC. All rights reserved.

How About the Duration Decision?

To explore duration considerations, we study the relation between the current market expectation for a change in the federal funds rate and term premiums next month.

We define term premiums as the USD-hedged return difference between the 7 to 10 year and the 1 to 3 year government bond index for USD, EUR, JPY, and GBP.(6)

Again, as shown in Exhibit 4, we find no reliable relation between market expectation of federal funds rate change over a month and term premium in the subsequent month.

This result is still robust if we look at the relation between expected change in the federal funds rate over 3 months, 6 months, or 12 months and term premium in the subsequent month. Therefore, shortening portfolio duration in response to expected hikes in the future federal funds rate is unlikely to lead to better investment outcomes, either.

EXHIBIT 4

Federal Funds Futures and Government Bond Term Premium

Global government bond term premium (%) vs. expected 1-month change in federal funds rate at beginning of month (%), January 1989–June 2022

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. FTSE fixed income indices © 2022 FTSE Fixed Income LLC. All rights reserved.

Back to the Present

Just like recent changes in the federal funds rate, expected changes in the federal fund rates based on current market prices of federal funds futures do not have forecasting power for future bond returns and term premiums.

This is not surprising since the federal funds rate is just one of many factors in global fixed income markets driving bond returns across different currencies and durations.

For investors (who are inevitably stuck in the present), there is still a robust way to target higher expected returns in fixed income – by systematically varying their duration and currency allocation based on current term spreads across yield curves.

FOOTNOTES

(1) Settlement price on federal funds futures is 100 – average of daily effective federal funds rate during contract month. For more information about contract pricing, please see CME Group’s official contract specification page: https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.contractSpecs.html. Effective federal funds rate is calculated as a volume-weighted median of overnight federal funds transactions, published daily by the Federal Reserve Bank of New York: https://www.newyorkfed.org/markets/reference-rates/effr.

(2) CME Group federal funds futures volume and open interest: https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.volume.html

(3) CME FedWatch tool: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

(4) Return on cash is defined as the return on 1-month US treasury bill. We use US, German, Japan, and UK WGBI index USD-hedged returns as government bond returns for USD, EUR, JPY, and GBP respectively.

(5) We define the expected 1-month change in federal funds rate as the difference between next-month expected average federal funds rate and current-month expected average federal funds rate, which are calculated from the federal funds futures prices for these two months.

(6) For EUR term premium calculation, we used German WGBI 1-3Yr and 7-10Yr index returns.

GLOSSARY

Basis Point (bp): One basis point equals 0.01%.

Federal funds rate: The federal funds rate is the interest rate at which depository institutions lend balances at the US Federal Reserve to other depository institutions overnight.

Federal funds futures: Federal funds futures are monthly listed contracts that are settled in cash against the average daily effective federal funds rate calculated and reported by the Federal Reserve Bank of New York.

Effective federal funds rate: The effective federal funds rate is calculated as a volume-weighted median of overnight federal funds transactions, reported daily on the Federal Reserve Bank of New York website.

Duration: A measurement of the sensitivity of the price of a fixed income investment to changes in interest rates. Generally, higher duration bonds will have greater sensitivity to changing interest rates than lower duration bonds.

Term premium: The return difference between bonds with different maturities but similar credit quality.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmitting of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS Licence No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the target market determination that has been made for each financial product either issued or distributed by DFA Australia Limited prior to proceeding with any investment. Go to au.dimensional.com/funds to access a copy of the relevant target market determination. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.