While the All Blacks are one of the world’s most successful sports teams, Kiwi rugby fans have learnt not to expect them to win the World Cup at every tournament.

Likewise, while the NZ share market has punched above its weight over the years, that doesn’t mean it is going to be a winner every time.

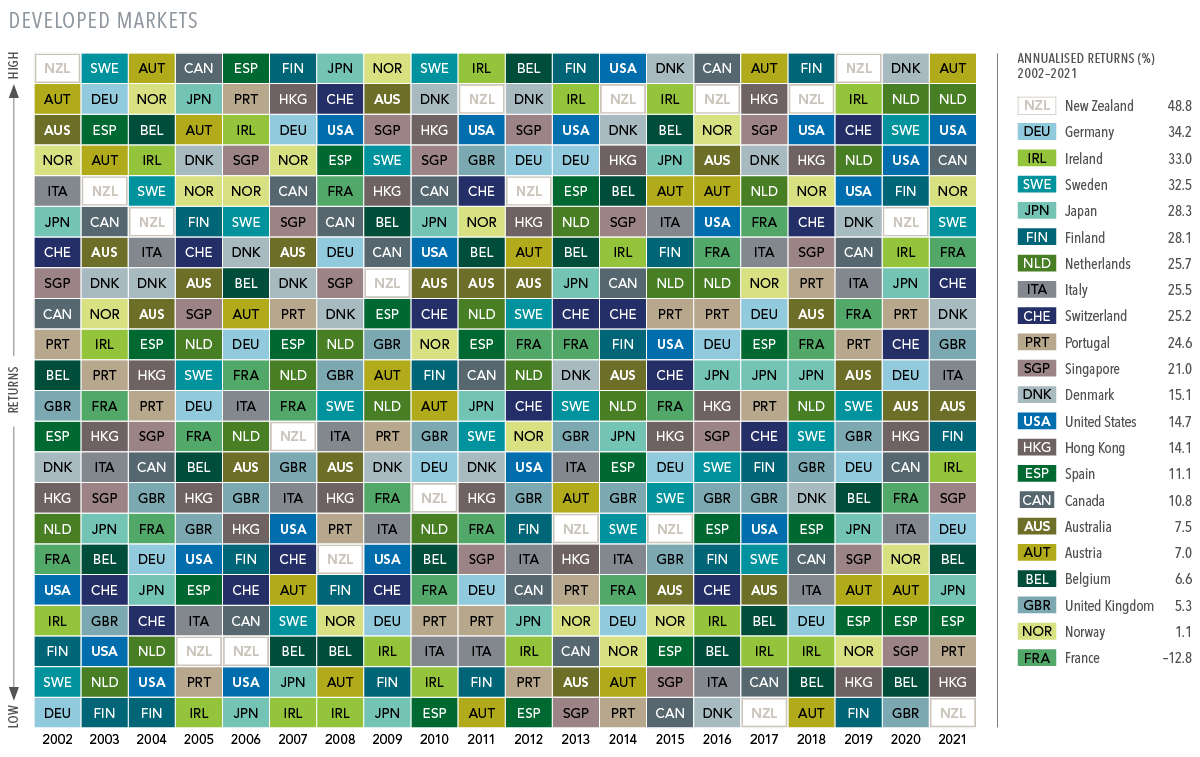

How good have Kiwi stocks been? Out of 22 developed equity markets around the world, the NZ market has featured among the top five performers in eight of the last 20 years. It held top position in 2002 and 2019 and second in 2011, 2014, 2016 and 2018.

But sometimes, like the All Blacks, it can get knocked out of contention. In 2021, for instance, the Kiwi share market was the single worst performer of 22 developed markets in NZD terms with a 12.8% negative return.

In fact, looking at the top performing countries from one year to the next it is hard to see any discernible pattern in the results. A top performer, like Canada in 2016, can just as easily slide down to near the bottom of the table the following year.

EXHIBIT 1

Randomness of Global Equity Returns

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

There is bad and good news for investors from this. The bad news is that while investment opportunities exist around the globe, the randomness of stock returns makes it exceedingly difficult to figure out which markets are likely to be out-performers.

The good news is that if your portfolio is sufficiently diversified, this shouldn’t matter. Being globally diversified means you don’t need to predict which countries will deliver the best returns during the next quarter, the next year or the next five years.

Holding equities from markets around the world, as opposed to those of a few countries or just one, positions you to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere.

Put another way, a globally diversified portfolio can help to provide you with more reliable outcomes over time. That is because you are spreading your investments more widely across different economies, markets, sectors and individual companies.

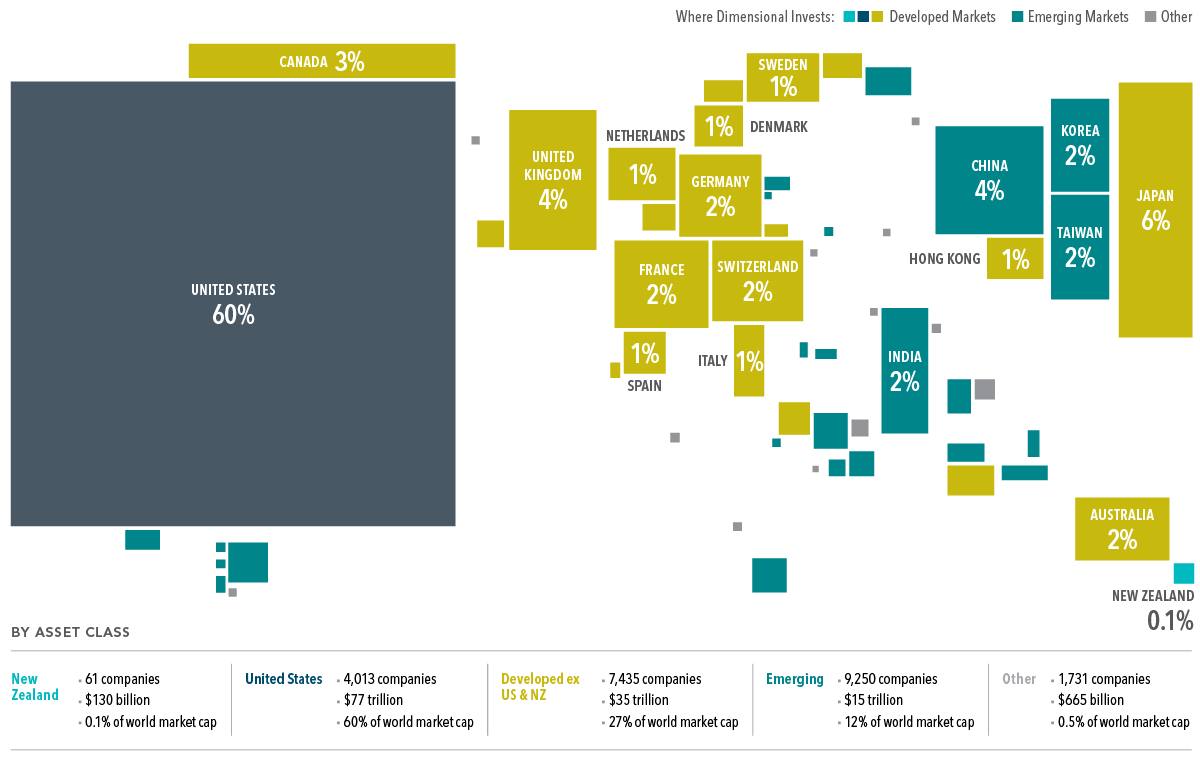

But there’s another reason for spreading your bets, particularly if your home country is a relatively small one. Together, the Australian and New Zealand markets represent little more than 2% of the global marketplace by value.

While NZ clearly punches above its weight in some many fields, its equity market is a rounding error in global terms.

This matters because the smaller your opportunity set as an investor, the more influence that idiosyncratic risk from the varying fortunes of individual companies and sectors can play in your portfolio.

Likewise, the bigger your available universe, the less a single company or sector will matter. Figuratively, you are fishing from a bigger pond.

EXHIBIT 2

Percent of World Equity Market Capitalisation as at 31 December 2021

Diversification neither assures a profit nor guarantees against loss in a declining market.

Just look at the numbers.

As of 31 December 2021, the NZ Stock Exchange played host to just 61 companies with a total market capitalisation of about $130 billion. By contrast, the Australian market hosted more than 10 times the number of companies with a market cap almost 20 times as much.

But if we widen our lens further, Australia and NZ look small. Dwarfing everything else is the US market, which hosted more than 4,000 companies with a total market value of $77 trillion and representing 60% of the global market.

A single company, Apple, had a market value of $4 trillion, or double the value of the entire Australian market.

And it doesn’t stop there.

There were close to another 7,000 companies in other developed markets outside the US, while emerging markets played host to more than 9,000 companies. You can see now that extending your pool of investable markets and companies increases your opportunity set and leaves you less exposed to the fortunes of a single company, sector or economy.

Just as a champion rugby team requires a mix of talents and skillsets – combining strength, speed, mental and physical resilience – a champion portfolio needs to spread its net widely.

It still doesn’t mean you’ll win every time. But through diversification you increase the reliability of outcomes, reduce the bumps and bruises along the way, and position yourself to capture the premiums available.

It’s how World Cup winners are made.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmitting of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.