Key Takeaways

– Market volatility can lead companies to adopt poison pills in an effort to block hostile takeover attempts.

– The market for corporate control, including hostile takeovers, can result in acquisitions at a premium, which can improve shareholder value.

– Dimensional strongly opposes poison pills and other anti-takeover mechanisms that may limit shareholder rights.

The board of Nordstrom recently adopted a poison pill after El Puerto de Liverpool, a Mexico-based retailer, built a 9.9% stake in the US department-store chain.

While Nordstrom claims the measure “is not intended to deter offers that are fair and otherwise in the best interests of all Nordstrom shareholders,”(*1)

Market volatility can lead to an uptick in hostile takeover bids.

Fearing falling public valuations, companies may adopt shareholder-rights plans.

These so-called poison pills force would-be acquirers to negotiate directly with the company’s board, rather than leaving the acquirer the option open to purchase shares directly from shareholders through a tender offer.

Typically, poison pills allow shareholders other than the would-be acquirer, the right to buy discounted shares.

Shares sold at a discount effectively dilute the position of the potential acquirer and make a hostile takeover more expensive.

Dimensional strongly opposes poison pills and other anti-takeover mechanisms.

We particularly oppose measures that have not been submitted to shareholders for approval.

We believe that the market for corporate control, which can result in acquisitions above current valuations, can benefit shareholders.

Takeover defenses, such as poison pills, can lead to entrenchment and reduced accountability at the board level – neither of which benefits independent shareholders.

A comprehensive survey of academic literature by Dimensional finds that anti-takeover provisions, like poison pills, generally reduce shareholder value.(*2)

Dimensional will generally vote against the adoption of poison pills.

Furthermore, we frequently vote against the directors who support poison pills. We maintain a list of directors who serve on boards of companies that adopt poison pills without shareholder approval.

Dimensional often votes against these directors any time they are up for election, including at other portfolio companies where they serve as directors, when we believe doing so is in the best interest of shareholders.

Dimensional’s stewardship activities have long opposed poison pills and advocated for the protection of shareholder rights.

In proxy year 2015, for example, Dimensional conducted a letter campaign on poison pills that reached over 200 companies.(*3)

Today, our stewardship activities continue to focus on poison pills and other shareholder-rights issues.

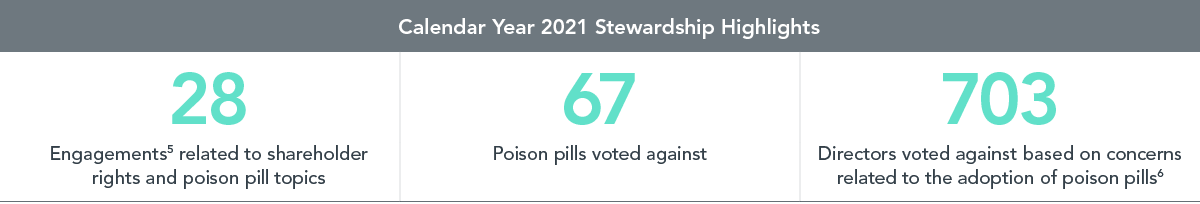

In calendar year 2021, Dimensional conducted more than two dozen engagements related to shareholder-rights and poison-pill topics at companies ranging from US-based Foot Locker to Sekisui House, a Japan-based construction company.(*4)

Furthermore, we voted against 67 poison-pill proposals and over 700 directors globally due to concerns related to the adoption of poison pills (see Exhibit 1).

EXHIBIT 1

Dimensional believes boards that represent shareholder interests are the foundation of good governance.

Our strong stance against poison pills and the directors who enact them is driven by our view that poison pills can decrease shareholder value.

GLOSSARY

Poison Pill: A shareholder-rights tactic used by a company’s board of directors that aims to dilute the ownership of a potential hostile acquirer.

Tender offer: A public proposal by a prospective acquirer that invites shareholders to sell their shares for a specified price during a particular period of time.

FOOTNOTES

(*1) Nordstrom Inc., “Nordstrom Adopts Limited Duration Shareholder Rights Plan,” news release, September 20, 2022.

(*2) Mathieu Pellerin, “The Economics of Corporate Governance” (research paper, Dimensional Fund Advisors, July 19, 2022). Available at SSRN.

(*3) Proxy year 2015: July 1, 2014–June 30, 2015

(*4) Dimensional can discuss governance matters with portfolio companies to represent client interests, though Dimensional does not, on behalf of its clients, acquire securities with the purpose or intended effect of changing or influencing the control of a portfolio company.

(*5) Dimensional’s Investment Stewardship Group and stewardship-focused Portfolio Managers engage with portfolio company management and board members at portfolio companies through phone calls, in-person meetings, or written correspondence.

(*6) Includes those up for election at other companies where they serve as directors.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS Licence No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the target market determination that has been made for each financial product either issued or distributed by DFA Australia Limited prior to proceeding with any investment. Go to au.dimensional.com/funds to access a copy of the relevant target market determination. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.