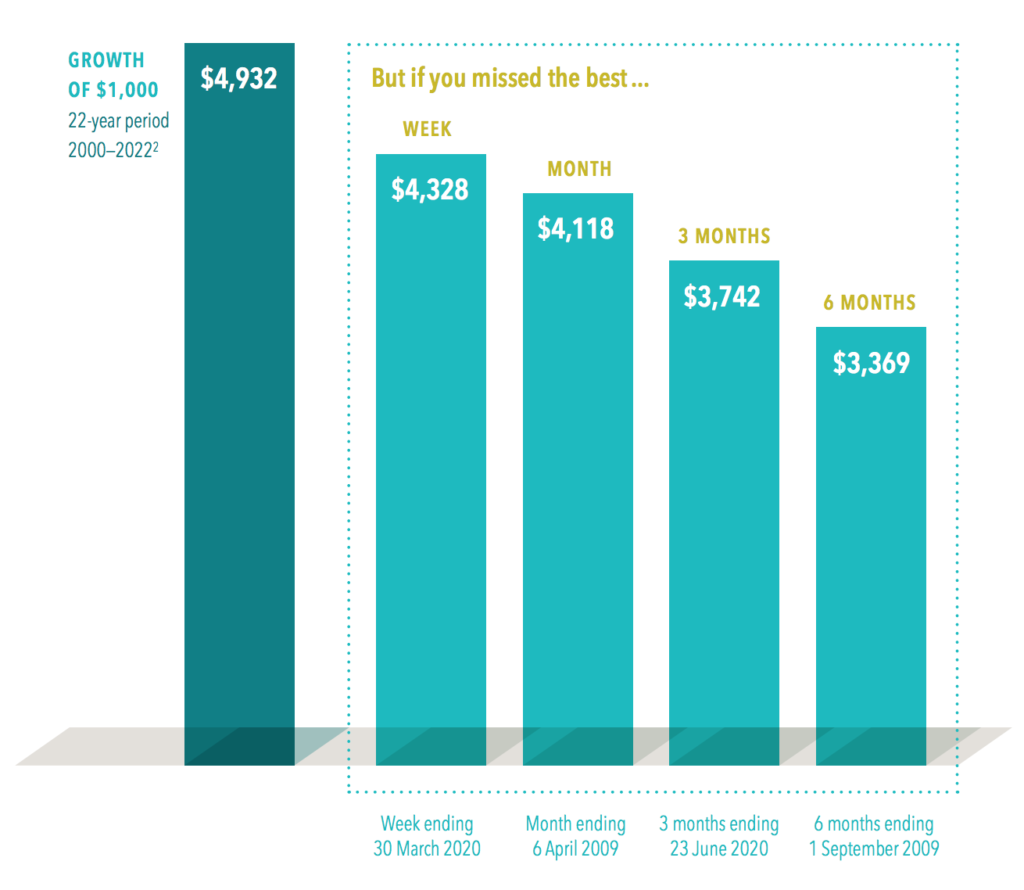

Missing only a brief period of strong returns can drastically impact overall performance.

S&P/ASX 300 Index (Total Return)(*1)

The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in the stocks that make up the S&P/ASX 300 Index, a broad Australian stock market benchmark.

Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.

– A hypothetical $1,000 investment made in 2000 turns into $4,932 for the 22-year period ending 30 June 2022.

– Over that 22-year period, miss the S&P/ASX 300’s best week, which ended 30 March 2020, and the value shrinks to $4,328. Miss the best three months, which ended 23 June 2020, and the total return falls to $3,742.

– There’s no proven way to time the market – targeting the best days or moving to the sidelines to avoid the worst. So the evidence suggests staying put through good times and bad.

DISCLOSURES

(*1) In Australian dollars. For illustrative purposes. Best performance dates represent end of period (30 March 2020, for best week; 6 April 2009, for best month; 23 June 2020, for best 3 months; and 1 September 2009, for best 6 months). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the S&P/ASX 300 Index at the end of the missed best consecutive days. S&P/ASX data reproduced with the permission of S&P Index Services Australia.

(2) Growth of $1,000 over a 22-year period 2000—2022. Return for 2022 through 30 June.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. AUSTRALIA This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.