Key Takeaways

– A Dimensional study shows that there are potential hidden costs associated with rigidly following an index.

– The stocks that make up index funds can see increased trading volume and price pressure when indices are reconstituted.

– A systematic daily investment process can help investors avoid the costs associated with index investing while still providing many of the benefits.

Imagine ringing in the new year in New York City’s Times Square with a million of your closest friends. Shortly after the ball drops, everyone is ready to leave – at the same time.

Demand for a ride in that area soars, and so does the price for the suddenly coveted service.

This dynamic surge is a lot like the index reconstitution effect, an important yet less-visible source of costs associated with index investing.

Index funds seek to mirror the performance of an index. To do that, they need to mirror the changes in the index’s holdings at the time of its reconstitution, when stocks are added to or dropped from the index.

This lack of flexibility can lead to increased trading volume and price pressure around that reconstitution, the so-called index reconstitution effect.

Two of the most widely tracked indices in the US are the S&P 500 Index and the Russell 2000 Index.

At the end of 2020, nearly $5.4 trillion in assets tracked the S&P 500. This means for every $1 invested in S&P 500 companies, 17 cents were indexed.*1

An additional $191 billion in assets tracked the Russell 2000 as of 2019, meaning about 10 cents indexed for every $1 invested in Russell 2000 companies.*2

With all of these assets tracking the indices, collective movements to mimic index changes may materially impact a security’s trading volume and price.

To examine the impact of index reconstitution on traded volumes and prices, we identify stocks that were added to or deleted from these two indices at an index reconstitution event over the past 10 years, from 2012 through 2021.*3

Our sample includes 2,998 additions and deletions in total, with 50 additions and deletions coming from the S&P 500.

Index investing has grown considerably in recent decades, with US equity index funds representing 52% of the US equity fund market at the end of 2021.*4

While index funds typically offer lower expense ratios than actively managed funds, our study shows that there are potential hidden costs associated with rigidly following an index.

Specifically, index fund investors end up buying index additions at high prices and selling index deletions at low prices.

These results highlight the importance of flexibility and efficiency in portfolio design, portfolio management and trading. A systematic daily investment process that rebalances thoughtfully and flexibly can help investors avoid the costs associated with demanding immediacy, while still providing many of the benefits of index investing.

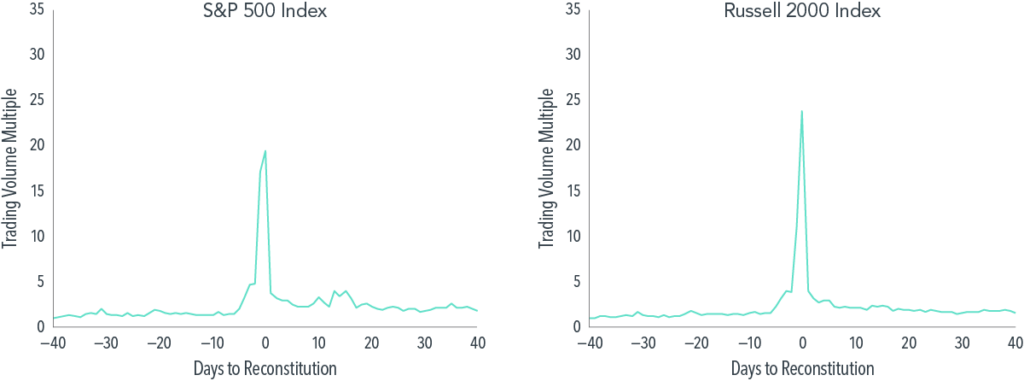

Exhibit 1 presents the value-weighted average trading volume for rebalanced stocks as a multiple of the stocks’ volume 40 trading days prior to reconstitution.

For both the S&P 500 and Russell 2000, additions and deletions experience a large increase in trading volume around reconstitution, as much as 20 times higher for the S&P 500 and over 30 times higher for the Russell 2000, relative to volume before the reconstitution period.

EXHIBIT 1

Pump Up the Volume

Value-weighted average daily trading volume multiples for index additions and deletions, 2012–2021

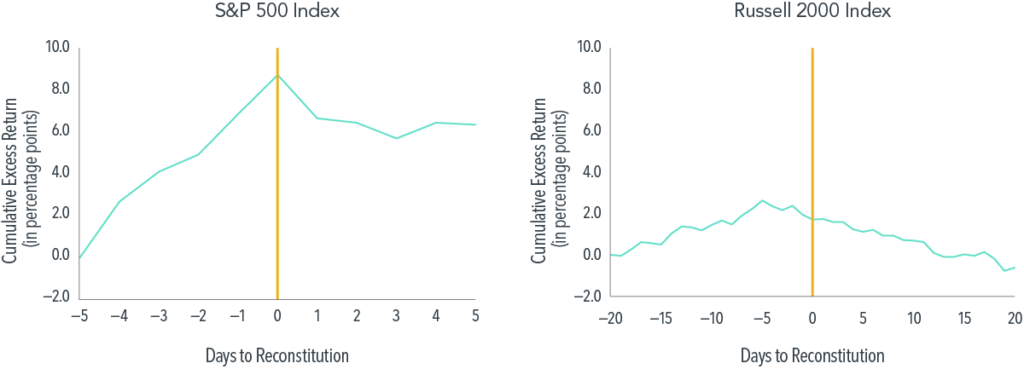

Since market prices are forward-looking and index rebalances are announced before reconstitution dates and often anticipated before announcement dates, the price impact due to index reconstitution often begins to accumulate before the actual reconstitution date.

Indeed, we find that stocks that are added to an index tend to go up in price prior to rebalance, while deletions tend to go down.

Exhibit 2 presents the value-weighted average cumulative excess return to added or deleted stocks relative to the index.

For both indices, we observe an increase in cumulative excess returns from the announcement date to the reconstitution date, followed by a reversal in excess return in the days following, on average.

For example, for S&P 500 additions and deletions, the average cumulative excess return climbed to almost nine percentage points over the five days prior to reconstitution and dropped by more than two percentage points the following day.

EXHIBIT 2

Get a Move On

Value-weighted average cumulative excess return of index additions and deletions since announcement dates, 2012-2021

Exhibit 1 References & Disclosures

Data compiled by Dimensional. The security-level trade-volume multiple is based on the ratio of observed daily volume levels over the event horizon relative to the observed daily volume 40 days prior to the reconstitution date. Value-weighted average-trade volume multiple is calculated by weighting the set of trade-volume multiples each day by the securities’ respective free-float market capitalisations, which are month-end values from the most recent month prior to the trade date. We exclude additions and deletions for stocks that migrate to other popularly tracked indices in order to avoid the potential conflicting trading pressure; additions and deletions to the Russell 2000 exclude migration firms that were included in the Russell 1000 immediately prior to or immediately after the reconstitution date. Additions and deletions to the S&P 500 exclude migration firms that were included in the S&P MidCap 400 or S&P SmallCap 600 immediately prior to or immediately after the reconstitution date. For the S&P 500, reconstitution events that occur on triple-witching dates, or days on which stock index futures, stock index options, and stock options all expire simultaneously, are excluded. S&P data provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Trading volume sourced from Bloomberg L.P. Multiples of t-40 volume is the trading volume at the specific time relative to trading volume at t-40 (40 days prior to index addition or deletion). Indices are unmanaged and cannot be invested into directly. Indices change their reconstitution dates and methodologies from time to time. The data depicted during the relevant period may reflect a number of different reconstitution practices. This data does not suggest that past performance will recur in future periods, as index reconstitution may be different in the future. Other simultaneous events, such as triple-witching dates, could lead to spikes in volume, in addition to reconstitution dates and fund trades that follow them.

Exhibit 2 References & Disclosures

Notes: Cumulative excess return (CER) is calculated as the cumulative sum of the daily excess returns for a given security vs. its respective index return. To examine deletions and additions together, the excess return for deletions is multiplied by –1. Value-weighted average CER is calculated by weighting the set of CERs on a day by the securities’ respective free-float market capitalisations, which are month-end values from the most recent month prior to the trade date. Additions and deletions to the Russell 2000 exclude migration firms that were included in the Russell 1000 immediately prior to or immediately after the reconstitution date. Additions and deletions to the S&P 500 exclude migration firms that were included in the S&P MidCap 400 or S&P SmallCap 600 immediately prior to or immediately after the reconstitution date. For the S&P 500, reconstitution events that occur on triple-witching dates, or days on which stock index futures, stock index options, and stock options all expire simultaneously, are excluded. S&P data provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Indices are unmanaged and cannot be invested into directly. Indices change their reconstitution dates and methodologies from time to time.

Footnotes

*1 Estimate of assets tracking the S&P 500 from “Annual Survey of Assets,” published by S&P Dow Jones Index. Total market capitalisation of S&P 500 as of December 31, 2020: $31.7 trillion, sourced from S&P Dow Jones Indices.

*2 Estimate of assets tracking the Russell from 40+ years of research reports published by FTSE Russell, available at https://content.ftserussell.com/sites/default/files/russell_2000_-_40_years_of_insights_final.pdf. Total market capitalisation of Russell 2000 as of December 31, 2019: $2.1 trillion, sourced from FTSE Russell.

*3 The constituents that make up these indices are determined according to an index methodology and are changed periodically throughout the year based on index guidelines. For the Russell 2000, there is an annual reconstitution in June based on stocks’ market capitalisations computed typically two months prior to the reconstitution date. Index changes are officially announced three weeks prior to reconstitution. The S&P 500 reconstitution schedule is more fluid, with the S&P committee making changes to index constituents on an as-needed basis. Changes are typically announced five days prior to reconstitution date.

*4 Data sourced from Morningstar; funds of funds are excluded.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmitting of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Risks

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Australia

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.