Investment opportunities exist all around the globe – and it’s hard to know where next year’s best returns will appear.

A globally diversified portfolio can help capture a broad range of returns and deliver more reliable outcomes over time.

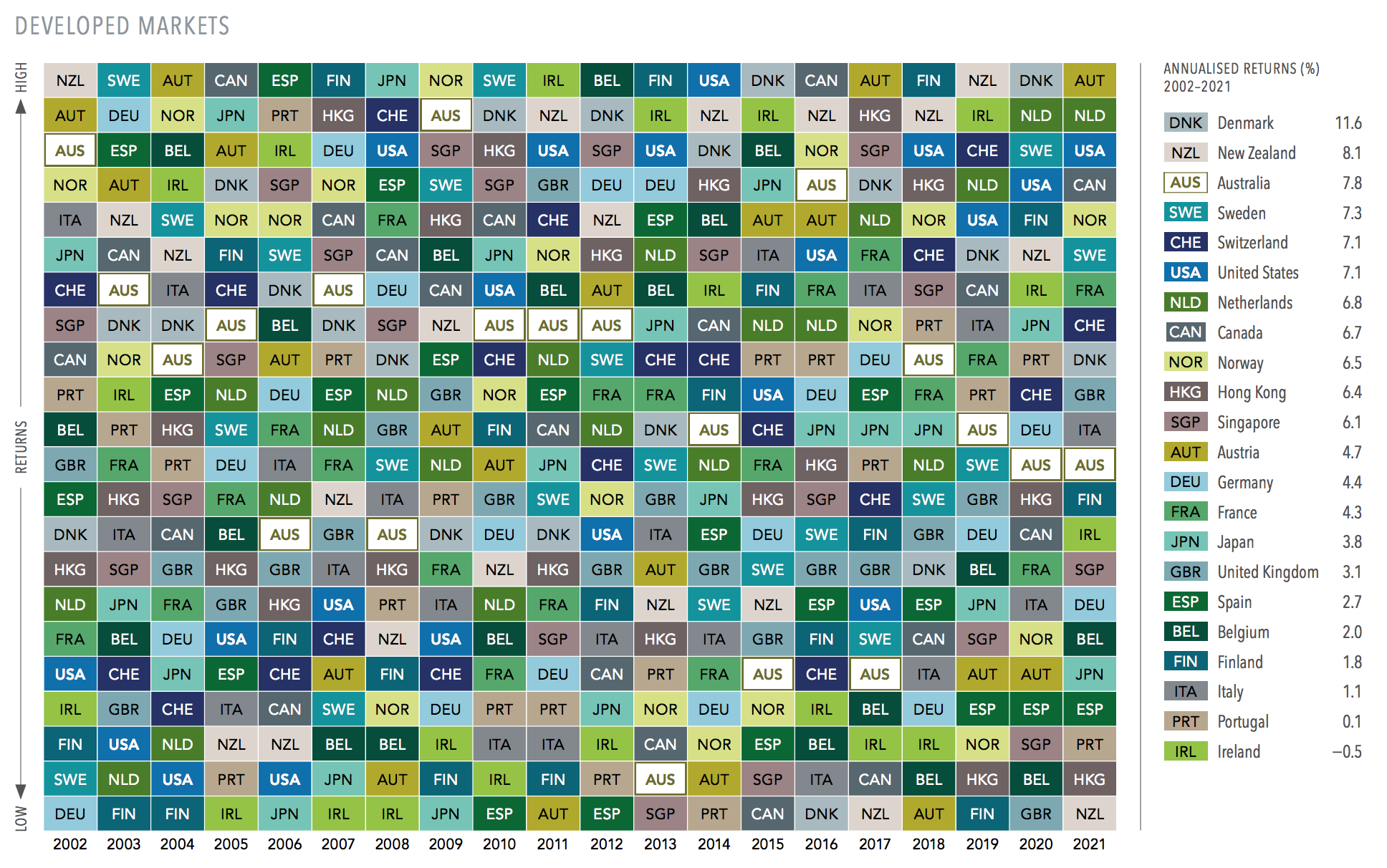

It is difficult to predict future returns by looking at the past, as shown by the performance of global markets since 2002.

This table below powerfully demonstrates the randomness of global equity returns.

Past performance is no guarantee of results. In USD. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2021, all rights reserved.

The table illustrates 20 years of annual returns in 22 developed markets. Each colour represents a different country. Each column is sorted top down, from the highest-performing country to the lowest.

The scattered colours suggest it is hard to predict which country will outperform from one year to the next.

Austria, for example, posted the highest developed market return in 2017 but the lowest the next year.

Investors holding equities from markets around the world can have a more consistent investment experience, with higher returns in one market helping offset lower returns elsewhere.

A globally diversified portfolio can help provide more reliable outcomes over time.

DISCLOSURES

Diversification neither assures a profit nor guarantees against loss in a declining market.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

AUSTRALIA and NEW ZEALAND: This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to au.dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.