Our childhood upbringing can have a significant influence upon our attitudes with money as an adult.

When growing up as a child, was money spent freely in the household, or was it a cause of conflict, or were budgets followed?

While beliefs about money can be passed from one generation to the next, we all have a choice to change them.

Some people exhibit money habits very different to the ones they grew up seeing, perhaps in a reaction to those circumstances or as a reflection of their personality.

Take a look at a family of siblings and you might notice very different money personalities.

By identifying your own patterns of thinking with money, you can possibly identify areas in which to aim for a more ‘balanced’ approach towards money management, that could fundamentally improve your financial situation.

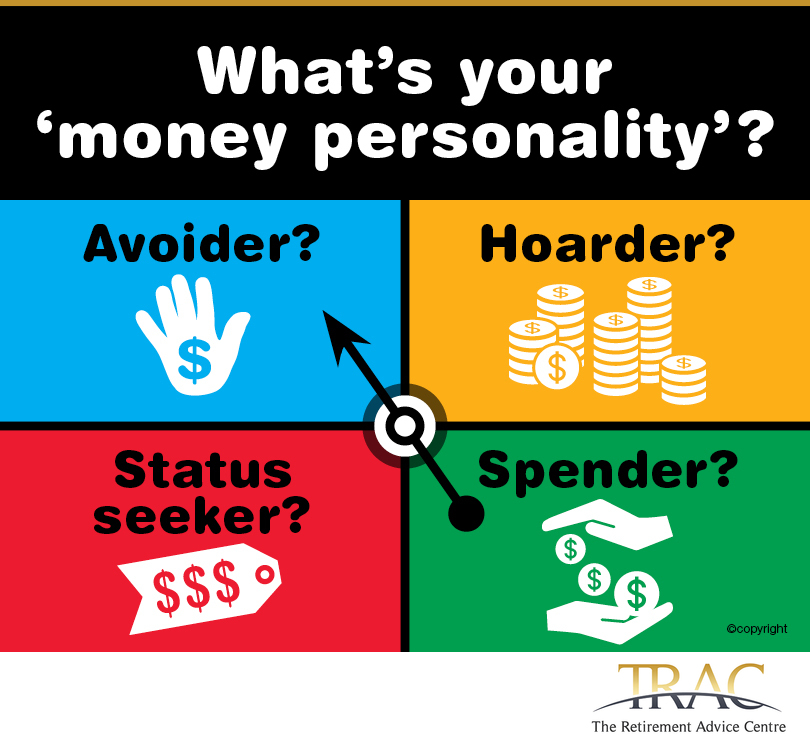

Here are four of the most common money personalities:

Avoider

As the name suggests, an avoider doesn’t want much to do with money.

They don’t want to spend time thinking about it and little attention is spent on investing and saving. There are many reasons why someone could be a money avoider, but two common ones are either feeling overwhelmed or confused around financial matters, or believing that money represents greed so it’s not healthy to focus on it.

Hoarder

This money personality type excels with saving but struggles to spend.

This can lead to Scrooge-like tendencies, as the hoarder finds it difficult to part with their money. They’re anxious that money could be taken away from them and they must have substantial savings at all times.

The hoarder doesn’t have fun with their money – the greatest enjoyment they get is knowing it’s untouched.

Spender

The opposite to the hoarder, the spender enjoys buying things for themselves and loved ones, making them very generous.

However it can be risky if they spend more than they earn.

They risk falling into debt and struggle to save enough money for substantial purchases such as a house deposit. Delayed gratification is foreign to the spender, who’d rather buy on impulse.

Status seeker

Unlike the other money personality types, whose habits might go unnoticed at first, there’s no mistaking the status seeker.

They’re the ones with the newest gadgets, flashiest cars, most fashionable clothes.

The status seeker uses money to exalt their image. They have high standards and are deeply invested in how others see them. Like the spender, the status seeker risks going into debt if they can’t afford their lifestyle.

Now What?

Perhaps you identify strongly with one of these types, or can see yourself in several.

None are inherently bad, but they all represent unbalanced attitudes to money.

While many of these beliefs can be quite entrenched, it is possible to change your thinking and foster a more positive money mindset.

Here are some tips to bring these beliefs into equilibrium:

1. Understand the emotions that drive your decisions

The money hoarder tends to be driven by anxiety, while for the status seeker it’s insecurity.

Identify your emotions – this observation will make you more aware of how you view and use money.

2. Create and maintain good money habits

A budget provides a clear picture of where money is going.

They’re useful for everyone to have, but are especially helpful for the spender and avoider.

3. Stop comparing yourself to others

The status seeker is the worst offender, but many of us also buy things to impress others.

Focus on what you want and don’t worry about keeping up with the Joneses.

4. Communicate with your partner about money matters

It’s possible you and your partner are different money personality types.

Ensure you’re on the same page about shared spending, saving and long term goals.

5. Practice gratitude

Appreciating what you already have will cut down on any unnecessary spending and anxiety around your finances.

6. Get assistance

Whatever your attitude to money, it’s always worthwhile having someone supportive to assist you to make the most of your financial situation.

We are here to help.