Blog

Elevating your Mood… Naturally

If it’s been a while since you had that wonderful feeling of euphoria, there are measures you can take to elevate your mood by encouraging production of your bodies naturally Read more…

Sharing Super a Win-Win for Couples

Australia’s superannuation system is based on individual accounts, with men and women treated equally. But that’s where equality ends. It’s a simple fact that women generally retire with much less Read more…

Sowing the Seeds of Succession

Succession planning can be difficult at the best of times without dealing with the added pressures farmers have recently faced with droughts, fires and floods. And that’s why it is Read more…

Australian Elections and Markets

Of all the set-piece news events regularly covered by the media, none generates as much noise as a federal election. With voters due to go the polls in Australia on Read more…

The Road Ahead for Shares

Trying to time investment markets is difficult if not impossible at the best of times, let alone now. The war in Ukraine, rising inflation and interest rates and an upcoming Read more…

Have the Tech Giants Been DeFAANGed?

By Wes Crill, PhD Head of Investment Strategists and Vice President Investors expecting FAANG(*1) stocks to continue the extraordinary performance of recent years must be disappointed by their returns in 2022 (see Exhibit 1). Read more…

Meme Investing? Try Human Ingenuity Instead

By David Booth Dimensional Executive Chairman and Founder. We’ve all been conditioned to see meme investors and Wall Street in opposition, but it seems to me that they have a lot Read more…

Four Ways to Improve the Probability of a Good Retirement

By Robert C. Merton, PhD Nobel Laureate and Resident Scientist at Dimensional. Around the world, individuals are being asked to take on greater responsibility for their own retirement. In the US, Read more…

Is Active vs. Passive Actually Passé?

The active versus passive debate may still raise a pulse in some circles. But Dimensional’s Head of Investment Strategists, Wes Crill, argues those labels don’t mean much anymore. In our Read more…

Making Sense of Bonds

“Why are my bond returns negative? Isn’t this the defensive part of my portfolio? If inflation is rising and interest rates are about to go up, should I be in Read more…

2022 Federal Budget Summary

This year’s Federal Budget covers a range of measures aiming to reduce the pressure from increased costs of living and help people into homes. Note: These changes are proposals only Read more…

Navigating Geopolitical Events

This is a great 5 minute article on Navigating Geopolitical Events by Karen Umland, Dimensional Senior Investment Director and Vice President. Russia’s invasion of Ukraine is an important reminder that Read more…

Why a Stock Peak Isn’t a Cliff

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out that the average returns Read more…

Is Now a Good Time for Value?

After a strong year for the value premium, investors are curious about what that means for value performance for this year. Investors haven’t missed the boat. Staying consistent in Read more…

Investing in Inflation

Inflation appears to be firmly on the rise and while that is bad news for consumers it’s not necessarily bad news for investors. In fact, inflation may provide new opportunities. Read more…

Estate Planning

If you are in the process of estate planning, you may be questioning the appropriate inheritance to leave your children. Leaving an inheritance to your children is a wonderful and Read more…

Money & Life Issues facing Australians in 2021

In August and September 2021, the FPA again surveyed 2,005 Australians to discover how the COVID-19 pandemic and consequent economic lockdowns had affected their work, income, financial habits and outlook.

Responsible Investing on the Rise

For many people, there’s much more to choosing investments than focusing exclusively on financial returns. Returns are important, but a growing number of people also want to be assured that Read more…

Aged Care Payment Options

When it comes time to investigate residential aged care for yourself, your partner, parent or relative, the search for a facility and how to pay for it can seem daunting. Read more…

13 worst performing superannuation funds – what does this mean for YOU?

The Australian Prudential Regulation Authority (APRA) recently released a report on the assessment of 76 MySuper products. This report compared all 76 superannuation products against each other, taking into account Read more…

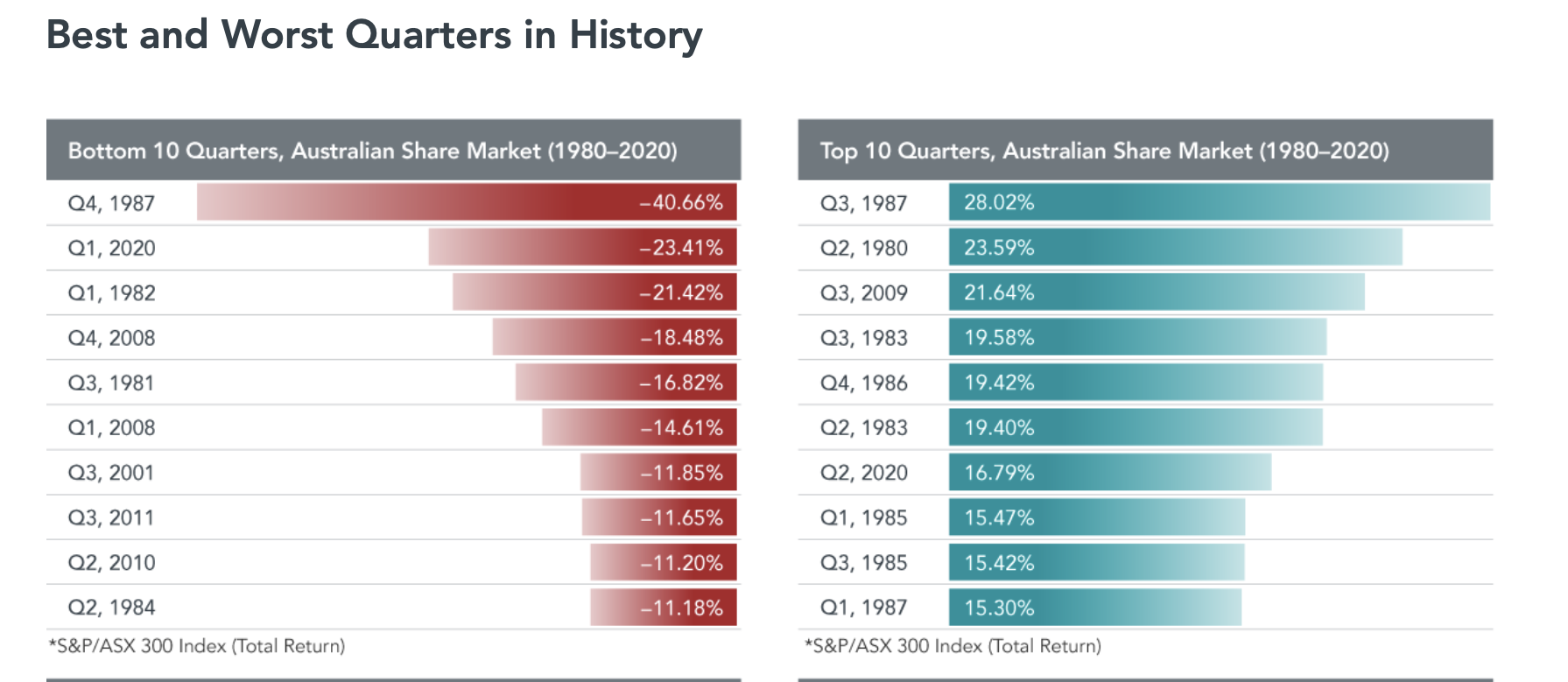

Every Quarter Counts

In this article, Jim Parker of Dimensional Fund Advisers, explores the high level of volatility for 2020 that’s worth a read for investors to understand the level of extremes Read more…

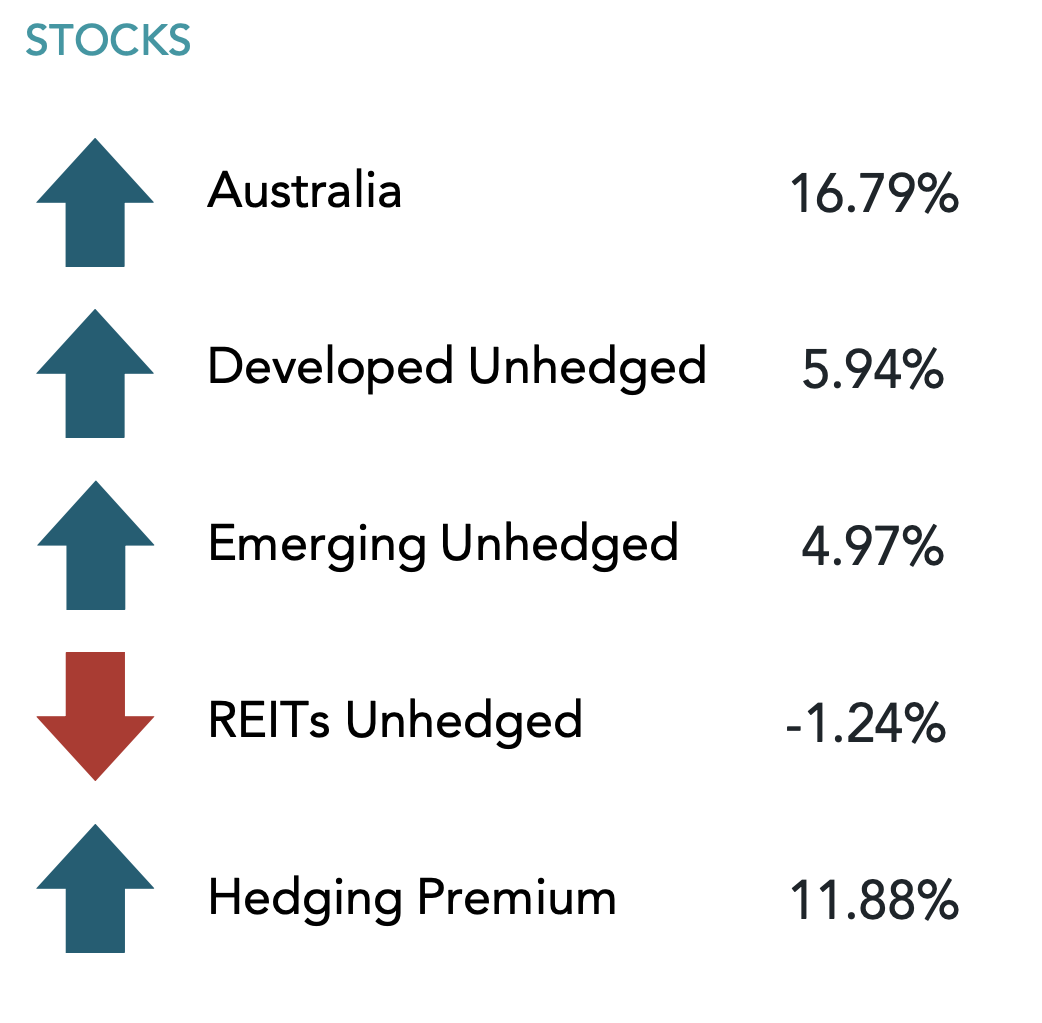

2020: 6 months of investment ‘whiplash’

One of the worst quarters for global stock markets in years was followed by one of the best in the June quarter. Investors looked past the initial shock triggered by Read more…

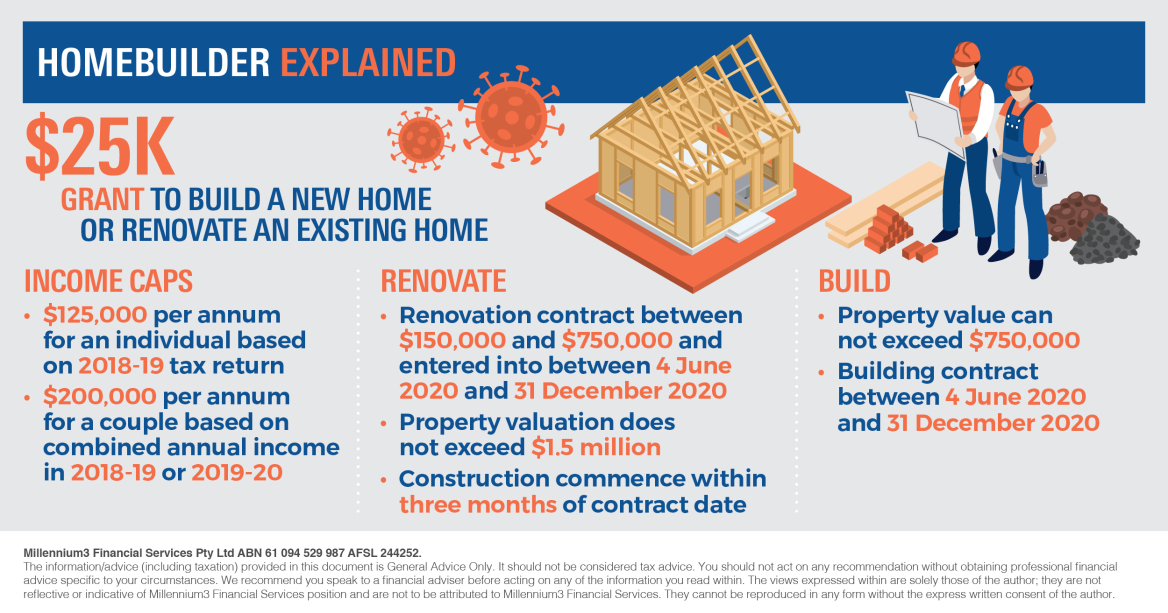

Homebuilder Government Program Explained

Due to the Coronavirus pandemic, the Australian Federal Government has embarked upon a number of measures to offer economic relief packages to help Australians through this period. Recently, theHomeBuilder scheme Read more…

Choppy Weeks Ahead: We Explain Why

Time and time again, it’s proven that investors are best served ignoring media noise and remain focused upon their long term plans. Sage advice indeed. It is also human nature to Read more…

Aged Pensioners benefit from Deeming Rate changes

Deeming is a key part of the Aged Pension social security income test. It is used to assess income from financial investments for social security purposes like bank account, shares, Read more…

How Can You Benefit from Record Low Interest Rates?

The Reserve Bank’s decision to cut official interest rates is good news for anyone with a mortgage or hoping to buy their first home. However, it’s tricky for retirees and Read more…

TRAC Most Valuable Practice Award

Last month our office manager Tracey Parkin represented TRAC with attendance at the dealer group’s Executive Education Program. Tracey attended Yale University for a management course and also visited global Read more…

Expansion of Pension Home Loan Scheme from 1 July 2019

More attention is being paid to Housing Wealth to assist Asset Rich, Cashflow Poor retirees in the USA. Equity home loans for retirees has a mixed history in both the Read more…

Additional 1 July 2019 Superannuation Changes

No More Work Test For Recent Retirees Effects those aged 65 to 74 with a total superannuation balance below $300,000 You will be able to make personal contributions for 12 Read more…

Important 1 July 2019 Superannuation Changes

From July 1 new rules come into place that may effect your super fund. Original Intent The changes are designed to protect the balances of superannuation accounts for members. Let’s say Read more…

Retirement on a Cruise Ship

One of the key insights from my time in Florida has been that everybody’s idea of Retirement is certainly different. Living half the year near family, then the other half Read more…

The 2019 Federal Election: Are you financially better off under Labor or Liberal?

The Federal Government election is near, and further details are being provided as to what changes each party is proposing. Labor is a firm favourite to win ($1.25 in markets) Read more…

Podcast of the Month

MIT’s Age Lab’s Joseph Coughlin was recently interviewed by the US postal service (UPS) recently. Joseph Coughlin is a leading expert around ageing and retirement as well as the Read more…

Recognition for The Retirement Advice Centre

At last month’s National Millennium3 dealer group conference in Cairns, the awards evening (in a tropical beach theme) was held. It was with great pride that we can let Read more…

The Price of Success

On hundreds of occasions I’ve met with a new client and we’ve discussed their financial situation. It’s pretty obvious huh…that’s why they walked in my door in the first place. Read more…

Meet the Team – Donna Martin

We continue our Meet the Team series with an informal question and answer session with adviser Donna Martin. As a mother of two, Donna is passionate about ensuring that Read more…

Meet the Team – Anna Thom

We continue our Meet the Team series with an informal question and answer session with Anna Thom. Anna is a member of our Client Services team since 2017 and Read more…

2019 Federal Budget Impact

How does the Federal Budget affect you? The Federal Budget explains to all Australians how the Government intends to manage the country’s finances. It outlines their tax and spending plans Read more…

The 3 Best Debit Cards for Travellers?

Whether travelling for business or holidays, arranging foreign exchange currency and knowing which cards to use is tricky. This article from another publication expresses their views on what the Read more…

Price of Success

On hundreds of occasions I’ve met with a new client and we’ve discussed their financial situation. It’s pretty obvious huh…that’s why they walked in my door in the first place. Read more…

Q & A Series – Meet the Team – Jarrod Lynch

We continue our Meet the Team series with an informal question and answer session with Jarrod Lynch. Jarrod is a member of our Client Services team since May 2016 and Read more…

New Research from the 2008 GFC & it’s implications for Australian Housing

In September 2018, Dean Baker of the Center for Economic and Policy Research published a white paper that analysed the Global Financial Crisis (GFC) called The Housing Bubble and the Great Read more…

Watch our February 2019 Economic Update

Watch our February 2019 economic update video for a brief summary of what’s transpired the past month.

Video: The Myth of Forecasting Markets

Video: The Myth of Forecasting Markets David Booth, founder of Dimensional explains the benefits of avoiding predictions, and to focus upon the historical stock market record and sticking to investing fundamentals in this video. Click here Read more…

2019 – What Lays Ahead?

It’s been a frantic start to the year, with so many questions arising out of last year. After a tough end of year for Stockmarkets, where to for 2019? December Read more…

Hayne Royal Commission commentary

The recommendations from the Hayne Royal Commission into Financial Services have been handed down. On Monday, the Government released the final report from the Royal Commission into Misconduct in the Read more…

Client Wins

Another channel we created within Slack is our ‘Client Wins’. It’s important that all of the team, including those in the back office working on the administration support and Read more…

Our Retirement Wall continues to grow

Our Retirement Wall continues to build and we’ve taken delivery of our 3rd champagne cork board this week (and one red wine cork as well) with the 4th in Read more…

Dimensional on market volatility (video)

The stockmarket level of volatility has been very quiet for many years. In fact, the level of movement has been at historical records for it’s plain sailing consistency. It’s Read more…

Insights to giving blood

For the past couple of years, our office has been utilising an internal communication platform called ‘Slack’. Slack is a type of instant messaging service that eliminates the need Read more…

Recommended Investment Podcast Listening

An investment advice firm in New York is owned by Barry Ritholtz whom has built quite a following on social media with his opinions. Barry has launched a podcast via Read more…

Q & A Series – Meet the Team – Adviser Mark Hardick

We continue our Meet the Team series with an informal question and answer session with Mark Hardick. Mark has substantial experience in the financial industry, and holds a genuine interest Read more…

Recommended Reading Ageing Well

Professor George Vaillant of Harvard University is the author of this book, a follow up to his NY Times best seller Ageing Well. I’ve listened to the audio version, which Read more…

5 Reasons For Market Volatility in October

October was an anxious month for investors as the US market fell 7% while the Australian market fell by about 5%. There was no single major reason for the Read more…

“Heartbreaking” Property Auction: Example of Anchoring Bias

In last weekend’s News.com.au article, a story of how a property, as part of a deceased estate, failed to reach it’s price expectations for the beneficiaries caused a lot Read more…

Flat Fee, Fixed Price Financial Advice For Retirement

The Retirement Advice Centre offers you the opportunity to work with an adviser based upon a Flat Fee, Fixed Price Membership Style pricing model. Payment is like a membership program. Read more…

Rising Interest Rates and It’s Impact Upon You

It doesn’t get a lot of media attention, but there has been a lot of action going on in the bond markets in recent months. This relates to the speculation Read more…

Podcast – The Pineapple Project

Recommended Listening If you’re interested in listening to a podcast about money subjects, without falling asleep, then I’d suggest The Pineapple Project is one of your best options. Hosted by Read more…

Recommended Reading: Age-Proof

Recommended Reading This book is authored by Dr Mike Roizen, a long time wellness expert of the Cleveland Clinic, and Jean Chatzky of the NBC Today Show. The book is Read more…

Lessons from the Forbes Rich List

Most people who are intent on building their personal and business finances know there is no quick road to wealth. While some people dream about their lucky numbers finally being Read more…

Accident Cover Life Insurance

Accidental Cover Life Insurance The royal commission this week is examining insurance companies and the direct outbound call centres that sell their products. The Australian Financial Review reported that the Read more…

Meet The Team – Sarah Broady

As part of our Meet the Team series, this is an opportunity to get to know each of us better with an informal chat. In this video we speak with Read more…

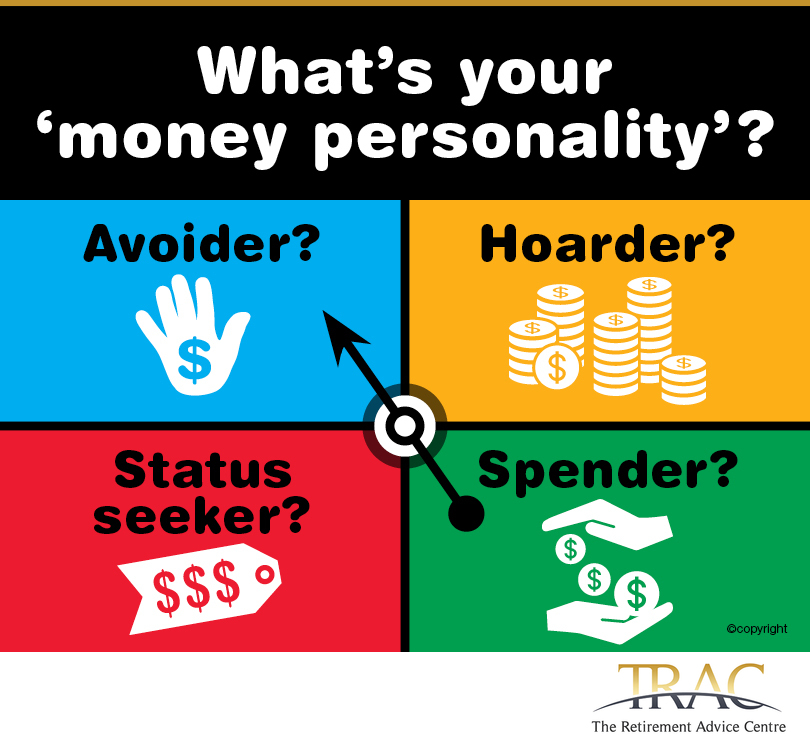

What’s Your Money Personality?

Our childhood upbringing can have a significant influence upon our attitudes with money as an adult. When growing up as a child, was money spent freely in the household, or was it a cause of Read more…

60 Seconds with Tracey Parkin

In March this year, Tracey Parkin clocked over a 10 year milestone being with our office. It honestly doesn’t seem that long ago when she started as a part-time administrator with Read more…

Plan for an EPIC Retirement

Your EPIC Retirement Plan Our new retirement video highlights four key areas to a thriving, successful retirement. Consider the opportunities that come with seeing retirement in an entirely new light. Read more…

Is it time to consider what Retirement means for you?

Whether you’ve been told you should retire at 65, or some other age, retirement is always a highly personal decision – at least in the traditional sense. Many of us Read more…

The Science of Retirement

Retirement is often envisioned as a bed of roses. All the hard working years are over, and now it’s time to put up your feet and relax. That’s what the Read more…

Grandparents (or Parents) investing for children – Tips

Grandparents and Parents often ask about how they go about investing money into shares for their kids or grandchildren. The tax implication of setting up ownership of these shares can Read more…

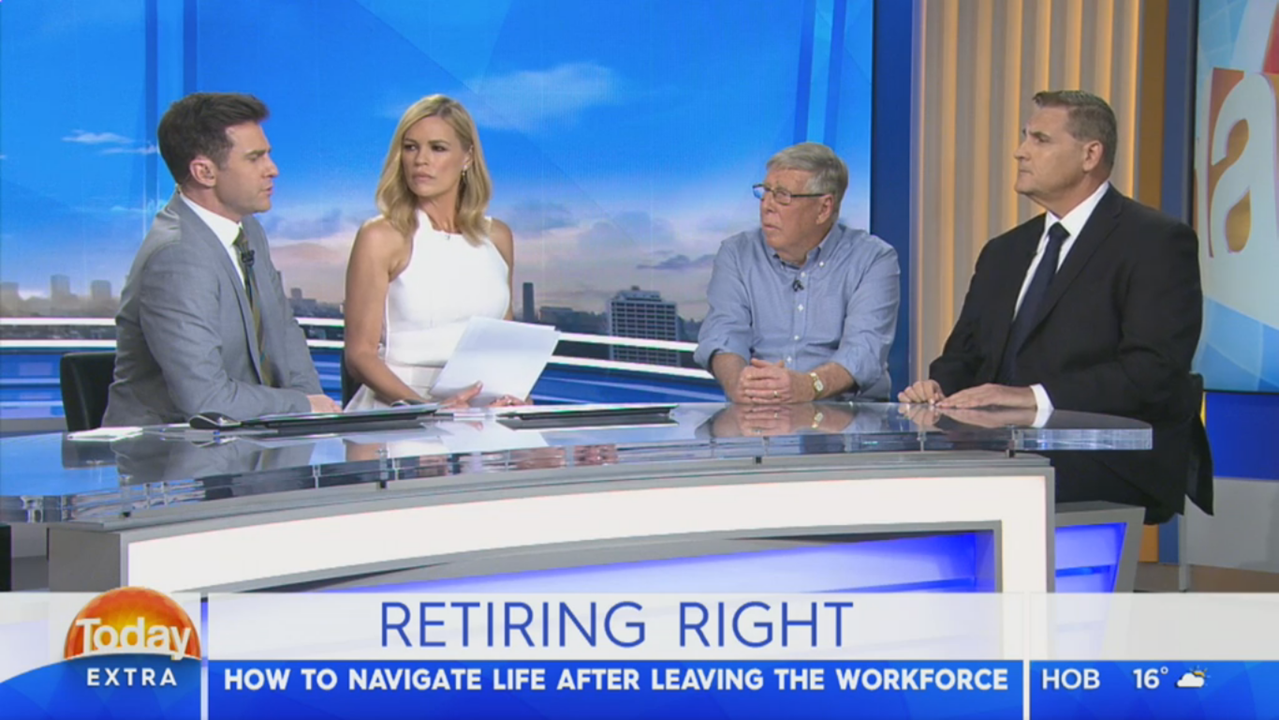

Retiring Right: how to navigate life after leaving the workforce

Retirement is referred to as the golden years, most of look forward to the day when we can hang up our work boots but for some people it can be Read more…

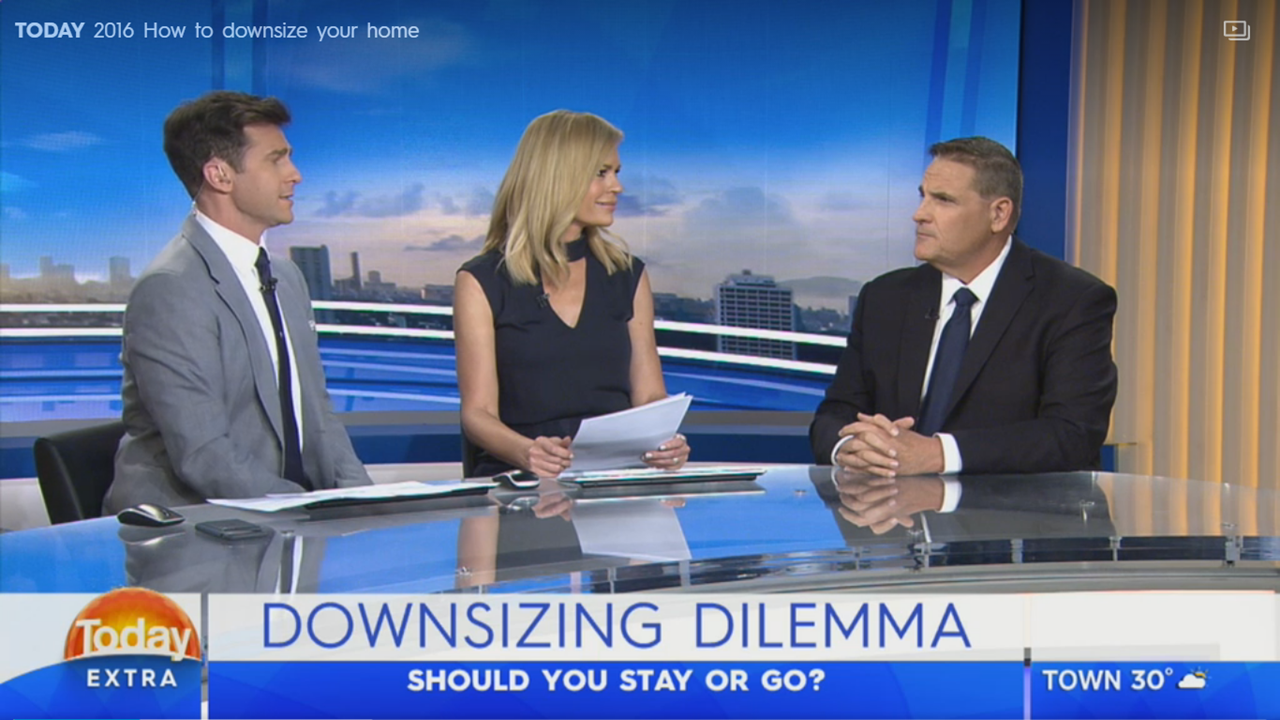

Downsizing Dilemma: Should you stay or go?

When you hit retirement and the kids have long flown the nest, many people consider moving to a smaller home, it’s a pretty big decision and you don’t want to Read more…

A new approach | FS Advice Cover Story

Kerry Sydee speaks with our very own David Reed in the cover story of the latest edition of FS Advice (Volume 11, Issue 02). Read what David has to say about the Read more…

TRAC Clients feature in magazine The Really Simple Guide to Money

In recent months a number of our clients were contacted by the journalist from The Really Simple Guide to Money. The feature of the magazine was exploring financial issues at Read more…

David Reed Wins 2016 Global Financial Planning Award

We are very proud to advise that our own David Reed has been formally announced as the winner of the 2016 Global Financial Planning Award (European Region which includes Australia, New Zealand and Russia). Read more…

Aged Care – Costs, Considerations and Concerns

Choosing how you age is not just about accommodation for you or your family. Aged Care brings up many questions such as Costs, Considerations and Concerns. There are also a Read more…

David Reed in line-up for top Global Financial Planning Award 2016

We are proud to announce that on the 22nd June 2016, David Reed was nominated as a Finalist in the Global Financial Planning Awards. The awards span across across three regions Read more…

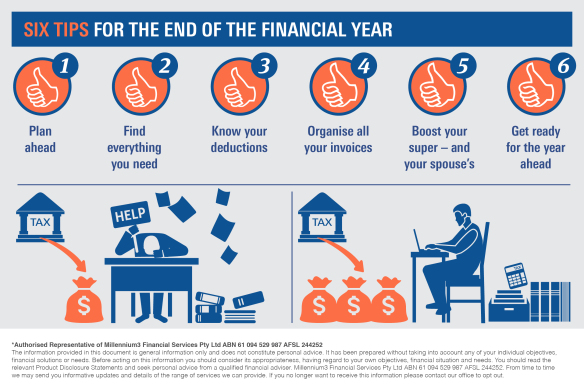

Six tips for the end of the financial year

June 30 is around the corner, which means it’s time to start thinking about your tax return. Read on to discover six tips for the end of the financial year and how Read more…

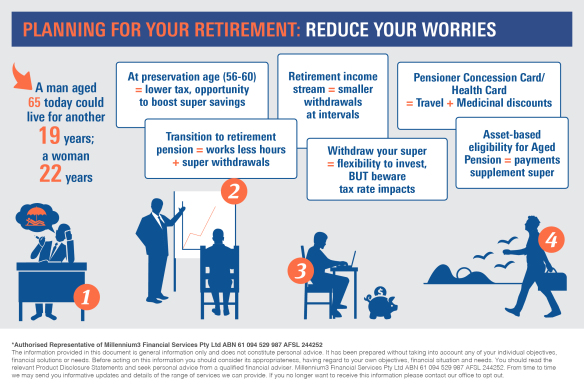

Planning for your Retirement : Reduce your worries

Planning for your Retirement early means you are in a better place to enjoy what really matters and reduce your worries. Read this guide to find out how – Entering Read more…

Re-Nesting the Egg – Australian Over 50’s Living and Lifestyle Guide

David Reed Australian Financial Adviser of the Year 2015 shares his thoughts on “Re-Nesting the Egg” with Australian Over 50’s Living and Lifestyle Magazine. David outlines important factors people should Read more…

Federal Budget – The Impact for Families and Wealth Accumulators

We have summarised the key features of the 2016-2017 Federal Budget for Families and Wealth Accumulators. Please click here to read more > Budget – Families & Wealth Accumulators If Read more…

Federal Budget 2016 – The Impact for Retirees and Pre-Retirees

We have summarised the key features of the Federal Budget 2016 – The Impact for Retirees and Pre-Retirees to review. Please click here to read more > Pre and Post Read more…

David Reed “Most Recommended Financial Adviser 2015”

David Reed awarded “Most Recommended Financial Adviser 2015” BOOK YOUR FREE APPOINTMENT HERE On 12 April 2016 in Melbourne the Beddoes Institute announced the 2015 winners and finalists of its Read more…

David Reed talks Retirement with 2GB’s Chris Smith

David Reed talks Retirement Planning with 2GB’s Chris Smith David suggests “Know what you are retiring to not just what you are retiring from”. Did you know – “The suicide Read more…

The average retiree spends 43.5 hours per week watching television

The average retiree spends 43.5 hours per week watching television. (Age Wave, 2012) Identify your values in life and discuss with others how your vision of retirement should be. Pleasure Read more…

The Paradox of Leisure in Retirement

The Paradox of Leisure – A retirement that totally consists of leisure must be a good thing, right? Psychologist Barry La Valley highlights an important perspective on this myth: “We Read more…

You need to make a “new normal” to enjoy ageing

George Vaillant conducted years of research from the Grant Study that launched in 1939 to identify that in his work ‘Ageing Well’, he wrote “…it is social aptitude, not intellectual Read more…

David Reed 2015 AFA Advisor of the Year presents at The Zurich ‘Blueprints for the Future’ Roadshow.

David Reed 2015 AFA Advisor of the Year presents at The Zurich ‘Blueprints for the Future’ Roadshow. Recently David was fortunate to be invited to present at the Zurich “Blueprints Read more…

How to keep your brain active

Neuroscience has proven that your brain is a muscle (Manin, Hong and Clark, 2013) Just like any muscle, if it’s not active it can atrophy and wither. The well known Read more…

Should you sell your family home when entering an Aged Care facility?

Should you sell your family home when entering an Aged Care facility? If you are part of the ‘sandwich generation’, ie. caring for your own kids and parents at the Read more…

Retirement is one of the top 10 most stressful life events

Retirement is one of the top 10 most stressful life events. (The Holmes-Rahe Life Stress inventory, The American Institute of Stress) When you are contemplating retirement, it is recommended that Read more…

The Next Phase Of Life – Retirement – Change how you feel

Changing The Way You Feel About This Next Phase Of Life – Retirement One of my goals is to consider retirement from the standpoint of how people feel about their Read more…

Focus upon retirement with Purpose and Meaning.

Successful Retirees are those that focus upon retirement with Purpose and Meaning. Those who succeed in retirement are those who obviously know what they are retiring from, but more importantly Read more…

50 years since Decimal Currency was introduced!

It’s funny looking back at major changes in life and remembering all the anxiety, opposition and upheaval that came with them. It’s hard to believe that it’s been 50 years since Read more…

How Do You Know When You Are Ready For Retirement?

How Do You Know When You Are Ready For Retirement? What does a successful retirement look like to you? The most common questions that I get asked are: – Do Read more…

2015 – AFA Adviser Of The Year Finalists Video

David has been nominated as a finalist for the AFA Adviser of the Year for 2015. This prestigious award will be hosted at the AFA Conference in Cairns on 27th Read more…

Retirement Advice Newsletters – 2015

Our 2015 series of newsletters can be viewed online by clicking on the Newsletter Header above and then the PDF below. October 2015 – The Retirement Advice Centre Newsletter Read more…

Retirement Advice Newsletters – 2014

Our archive of newsletters for 2014 can be viewed by clicking on the Newsletter header above.

Retirement Advice Glossary

Click on the following link to give you access to a quick reference guide to a range of superannuation and financial terminology. This Retirement Advice Glossary has been produced to Read more…

The ‘Your Guide To’ Series For Retirement Planning

The ‘Your Guide To’ Series For Retirement Planning Guide 1: Salary Sacrifice 1. Your Guide to Salary Sacrifice Guide 2: Transition to Retirement 2. Your Guide to Transition To Retirement Read more…